To celebrate the ATC's 50th anniversary as trade association and community of language service companies,…

The UK’s new, ten-year Modern Industrial Strategy was published by the Labour Government in June 2025 – but what does it mean for language service companies, as providers of multilingual services, and as SME businesses? This ATC Briefing decodes the essential and summarises next steps.

Focus on Growth in IS-8 Sectors

The UK’s new, ten-year Modern Industrial Strategy published in June 2025 focuses on economic growth, key high potential sectors, and support for SMEs. While the volatile world around us is changing, the UK Government seeks to provide strategic certainty for businesses to focus on growth and creating wealth:

“Our modern Industrial Strategy will help us seize the most significant opportunities and create the most favourable conditions in key UK sectors for the companies of the future to emerge here – the ones that have a transformative role to play in the clean energy transition, the tech revolution, the fundamental impact of AI on every sector, and the new geopolitics.

To achieve this, the Government is focused on the critical need to increase business investment, capturing a greater share of internationally mobile capital, spurring domestic businesses to scale up, and supporting small and medium-sized businesses reliant on resilient supply-chains. This is about positive choices: backing eight sectors (the IS-8) with the highest potential, and the frontier industries at their leading edge – and targeting the places and clusters across the UK that support those sectors, to increase national productivity, strengthen our economic security and resilience, and support our environmental goals and the net zero transition.”

At the heart of the strategy are the IS-8, eight highest potential sectors expected to lead the charge in innovation, growth, and international trade:

- Advanced Manufacturing

- Creative Industries

- Life Sciences

- Clean Energy

- Defence

- Digital and Technologies Economy

- Professional and Business Services

- Financial Services

These are the highly productive and innovative sectors backed by the Industrial Strategy to create strategically important technologies and services deployed across the economy and internationally, supported by the foundational industries supplying them.

For language service companies, focus on the IS-8 provides self-evident opportunities for moving deeper into these sectors as trusted partners for international growth, and for operating in the slip-stream of the support these key industries will be tapping into.

For the wider language services industry in the UK, the Industrial Strategy’s focus on Professional and Business Services may also open the doors for unexpected business, operations, and financial support. While the main focus on PBS within the strategy is on accountancy, audit and tax, legal services, and management consultancy, there is an opportunity for us to manoeuvre language services into position for enhanced support measures. These include increased tech adoption and innovation, developing a highly skilled workforce, entering new markets and growing exports, accessing growth finance, and providing international leadership in setting standards and regulations, as detailed in the Industrial Strategy’s Professional and Business Services Sector Plan.

In tandem with the Industrial Strategy, the Government’s new UK Trade Strategy reaches beyond the domestic into exporting and international growth. Its aim is to lower barriers to trade, expand the UK’s trade agreements, and support companies to move into international markets. Here, language service companies will play a distinct role in facilitating communication, opening market access, and supporting companies to participate in international bids – with huge returns promised, as in the Trade Strategy’s example on the potential of UK offshore wind powering Latin American markets:

Source: The UK’s Trade Strategy 2025

The Potential in SME Businesses

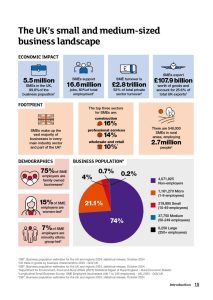

The UK’s 5.5 million SMEs provide 60% of private sector jobs and generate over £2.8 trillion in turnover, and it comes as no surprise that when small and medium-sized companies account for 99.8% of the business population, any strategy would do well to support them.

The Department for Business & Trade’s Plan for Small and Medium Sized Businesses highlights the potential of exporting to grow SME trade: In 2023, SMEs exported £107.9 billion worth of goods and they account for 25.6% of total UK exports. However, just over 1 in 10 (11.5%) of SMEs export, compared to 40% of large businesses – a clear opportunity for language service companies to provide multilingual communications not just to the high potential IS-8 sectors, but the huge untapped population of exporting and not-exporting-as-yet SMEs.

Source: Department for Business & Trade’s Plan for Small and Medium Sized Businesses

Tapping into SME Support

The Government’s enhanced focus on SMEs is, of course, a clear opportunity for SME language service companies to benefit from new business, finance, and digitalisation support measures.

A few key elements of SME support include:

- Streamlining access to government support, advice, and funding;

- Capping headline corporation tax at 25%;

- Building better and more far-reaching investment and funding opportunities and match funded grants;

- Introducing initiatives to tackle the issue of late payments;

- Supporting businesses to upgrade their cyber security;

- Retaining R&D tax credits to foster technological advancement;

- Enhancing skills and accelerating access to talent; and

- Supporting city regions, industrial clusters, and devolved nations.

The vehicles for many of the Government’s objectives are through new and upgraded advisory and information services and programmes: a new Business Growth Service, boosting tech adoption for SMEs by expanding the Made Smarter programme, and expanding the new AI Skills Hub to include professional and business services.

The UK Government is also currently developing a further Small Business Strategy to foster growth and productivity among smaller companies. Expected to be published later in the year, the Small Business Strategy will focus on creating a supportive environment for starting and growing a business, with even further business support for small language service companies to tap into.

What about Public Sector Procurement?

The new SME plan also includes measures to make it easier for SMEs to secure government contracts, with plans to create a simpler, more commercial and transparent regime building on the Procurement Act (2023) which came into force in February 2025 and includes a legal duty on contracting authorities to consider how they can remove obstacles to small businesses bidding for public contracts.

The aim of these new measures is to make SMEs a national priority in the new procurement policy system, including the launch of a new SME Procurement Education programme, and the formation of a new Defence SME Support Centre to simplify access to defence opportunities.

While this may sound like great news for small language service companies looking for a piece of the public sector pie, it remains to be seen whether the impacts will include any significant simplification of existing language services procurement processes for the simple reason that all but the largest LSCs in the UK are already firmly in the SME bracket, with fewer than 250 staff and a turnover of less than £44 million – and as of yet no special measures are in sight for supporting micro and small businesses specifically.

Next Steps for LSCs and the ATC

In light of the UK Government’s ambitious plans but with few results to show for them yet, what are the next steps for language service companies operating in the UK market, and for the ATC as their trade association?

For LSCs, the action points are clear:

- Move deeper into IS-8 sectors and position your business as trusted partner for facilitating international growth;

- Make use of the opportunities on offer for Professional and Business Services as a key IS-8 sector; and

- Tap into increased SME support, skills development, and funding.

For the ATC as the voice of language service companies in the UK, the next steps are equally self-evident.

We need to continue to engage with business organisations to beat the drum on the value of language services to export and international trade. As active members of CBI, the Confederation of British Industry and TAF, the Trade Association Forum, we are well-placed to make our voice heard, and to expand our advocacy with e.g. the reformed Professional and Business Services Council, a key partner for the Government in the implementation of the PBS Sector Plan.

We also need to keep our ears close to the ground for new initiatives and support measures and services. In this, our close partnership with the UK Export Academy (changing its name to the Business Academy and expanding its remit) will be pivotal. In its new role with an expanded remit to support all areas of business growth, we will have a front-row seat to find out what’s happening, what’s possible, and what we need to keep our members informed about.

Together, we can make the most of the opportunities and support that a growing, more resilient UK business landscape can offer.