Global Horizons Showcases International Trade Insights in Collaboration with Leading Industry Bodies

The Association of Translation Companies is collaborating with the Chartered Institute of Export & International…

The ATC’s first Coronavirus Pulse Survey asked the UK’s language service companies how the pandemic has affected their business, and what financial support measures offered by the UK Government they have accessed.

Below, we share the initial results; the reality of businesses at a cliff edge, but also glimpses of survival stories.

The Pulse Survey will be taken again in mid-May, for real-time, continuous tracking of the effects of coronavirus on the UK’s language service companies.

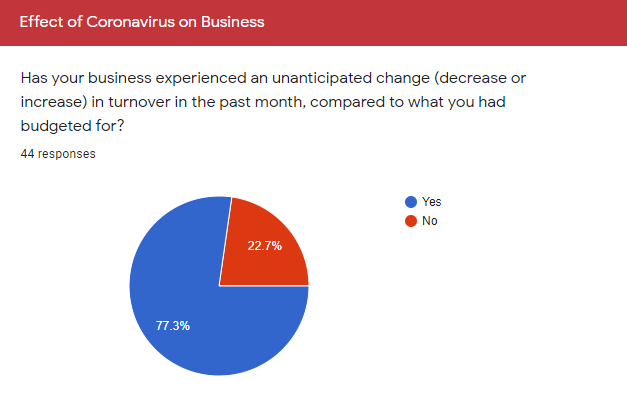

The extent of the Coronavirus business effect on UK language service companies is sobering.

Over three quarters of the survey’s 44 respondents experienced an unanticipated change in turnover in the past month, compared to what they had budgeted for before the pandemic.

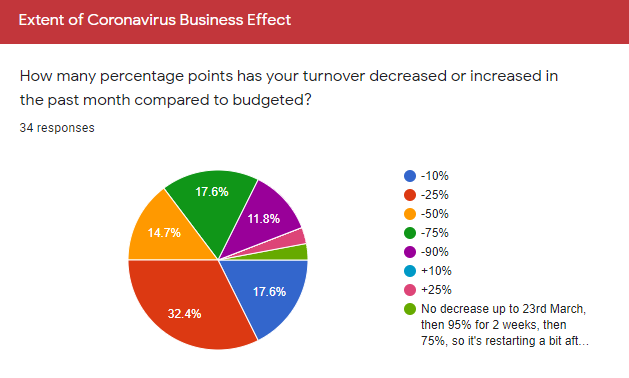

Out of the 77% feeling the coronavirus effect,

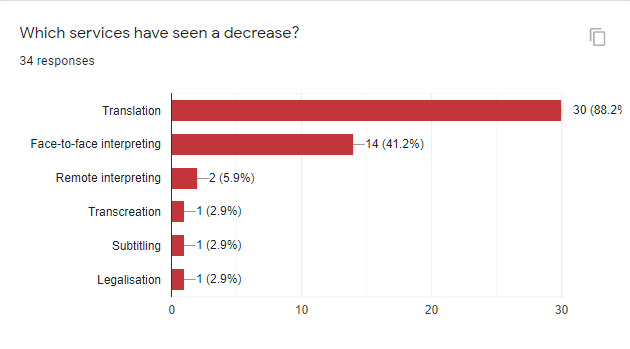

Both translation and face-to-face interpreting have seen a significant decrease. Out of the respondents feeling the coronavirus effect, 88% reported a decrease in translation services, and 41% in face-to-face interpreting.

Unsurprisingly, the range of verticals and sectors affected is wide. Between 6 and 10 respondents reported a decrease in turnover in the following verticals:

It appears not for all companies.

Although the effect of the pandemic is significant for a majority of language service companies, nearly a quarter of respondents have not yet experienced a negative coronavirus business effect, which may indicate that certain business models or verticals are much more resilient against the pandemic’s effects than others.

We will drill down into these survival stories in the Pulse Survey’s next instalment in May.

Predictably, remote interpreting has surged for some, with 9 respondents reporting an increase in remote interpreting services.

Equally predictably, perhaps, it is verticals such as IT & Telecoms, Life Sciences and Education & Training that respondents are reporting to be on the increase.

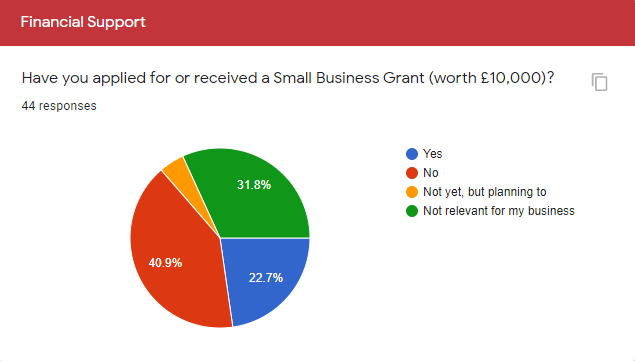

The UK Government’s financial support for SME’s includes a range of measures from small business grants to access to lending facilities, but are these measures hitting the mark with language service companies?

The Government’s Small Business Grant worth £10,000 is administered by local authorities for eligible small businesses, and 27% of respondents have already applied for or received it, or are planning to apply.

However, 41% of respondents have not applied for the grant, and it will be interesting to follow how these figures change as we move from the first weeks of the pandemic towards the long haul.

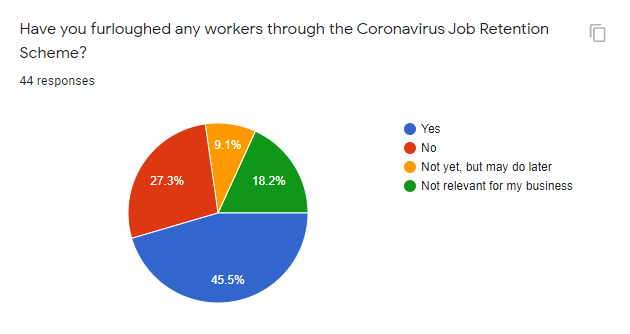

As work dries up, another timely support measure is the Government’s Job Retention or “Furlough” Scheme, designed to help companies retain employees on payroll even though they aren’t working, and to prevent mass unemployment.

Having opened up this week for applications, the furlough scheme provides a cash grant worth up to 80% of the salary of an employee who might otherwise be laid off, up to £2,500 per month.

And it seems to be needed: over 45% of language service companies have already furloughed staff.

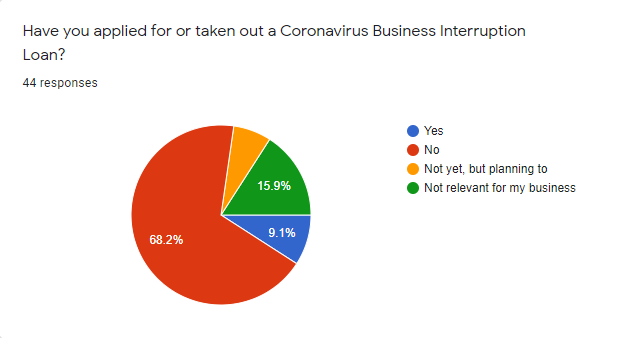

Another element of financial support available is a Government-backed business interruption loan, but it’s clear that language service companies are cautious about their financial position and their ability to service such a loan.

Over two thirds have not applied for or taken out a Government-backed business interruption loan, against 16% who have.

The first Pulse Survey also gauged respondents’ views on how the ATC can support its members at this critical time; by sharing information and providing advice targeted for the language services industry, lobbying the Government, and keeping Brexit in mind.

Thank you, it’s good to know that you are there and looking after the interests of our sector.

Provide advice targeted to our sector with case studies

Information on how our industry is affected in the UK, which is the purpose of this survey.

Lobby government about the importance of supporting the service sector and make help available specifically to the service sector, as the current help is not widely available for small LSPs.

Keep lobbying the government to make sure that they know all about our industry and the vital role we play. This could help to give us some dispensation on immigration later.

Campaign for early phased removal of lockdown.

Let us know if you hear of any suggestions that the Brexit transition period will be extended beyond 2020 as a result of the UK and EU negotiating bodies not having enough time to get the deals/discussions/rules for post-transition ready in time.