The autumn is packed full with engaging, insightful events by the ATC and our global…

Is business good, bad, or just about muddling along? How does the economic and cost of living crises impact the growth of language service companies? One key indicator on how the winds are blowing is the development of rates and pricing trends. In this article, we look at recent survey and research data, and invite you to share your latest insights on where rates are heading.

Back in the good old days of 2022

In 2022, the language services industry in the UK and globally was emerging from a COVID-induced hiatus in business, and starting to cautiously look forward to a re-energised market with room to grow.

The 2023 ATC UK Language Services Industry Survey and Report revealed that, in 2022, prices in the UK were on the rise, although not with all companies.

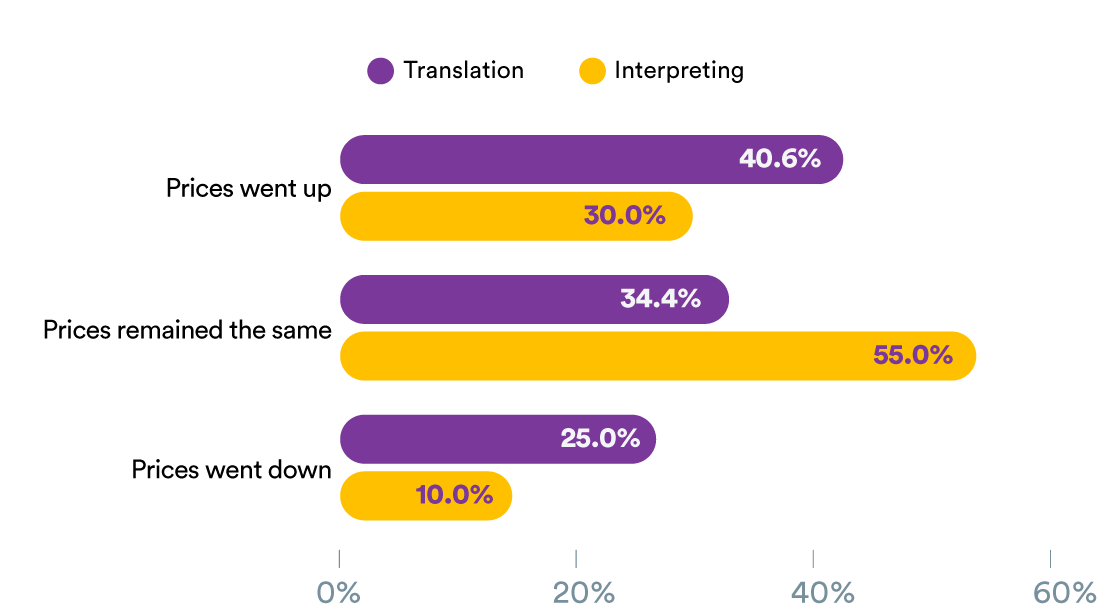

This was especially true of translation services, where 40.6% of companies reported increasing their prices in 2022, compared to just 14.3% in the previous study in 2020 – but against a backdrop of a quarter of companies reporting a drop in prices. Interpreting prices had remained more modest, but with a clear lean toward increasing rather than decreasing prices in this industry, too, with 30% of companies reporting an increase in prices for interpreting, as opposed to 20.7% in 2020.

Source: 2023 ATC UK Language Services Industry Survey and Report

While this was the situation at the beginning of 2023, the current economic climate was already then starting to catch up with the language services industry. While the 2023 survey data showed that companies were tending to increase prices, many companies reported that these increases just barely kept up with inflation rates in the UK – bringing up the question of whether a price increase can be called that if it’s not a real increase in economic terms.

Since then, the word on the street has been that from the start of 2023, there has been very little room for price increases.

Straight into another economic crisis in 2023

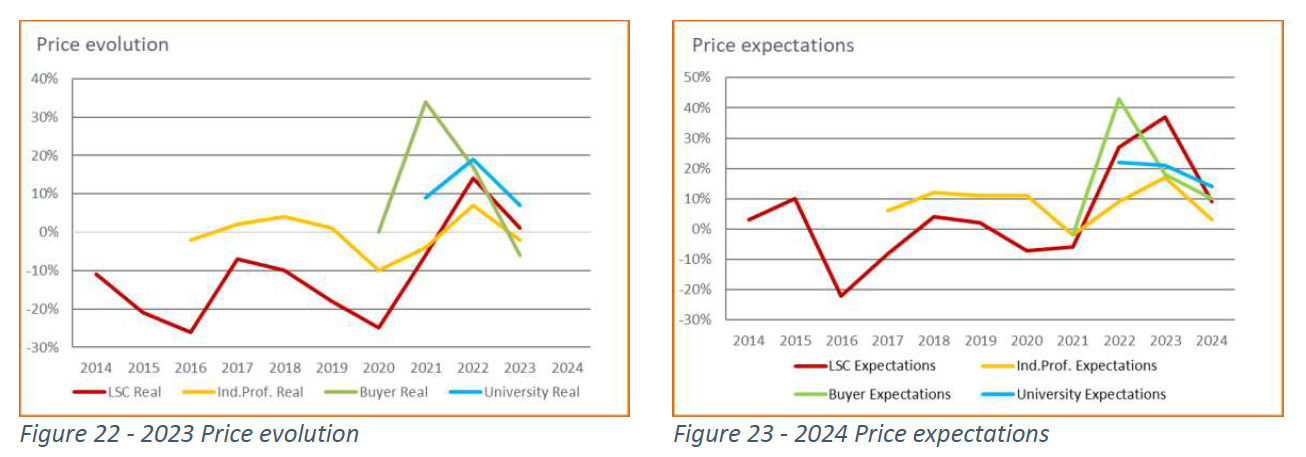

At a European level, the latest European Language Industry Survey ELIS results are sobering. Based on the price evolution in 2022, many language companies and freelancers had been expecting price increases to continue in 2023 – language service companies at a rate of 15%.

In 2023, these hopes became a pipe dream. The price evolution with European language service companies with a cohort of 257 respondents was 0%, and this evolution was confirmed by the average word rates reported by language company participants, including respondents from the UK.

Source: ELIS 2023 Report

And what now, in 2024?

As an indicator of tough times for business, these pricing trends paint a picture of clients’ very, very careful scrutinising of spending, of continued slow economic growth, and perhaps also of the disruption brought forward by the rapid acceleration of AI-enabled tools and processes.

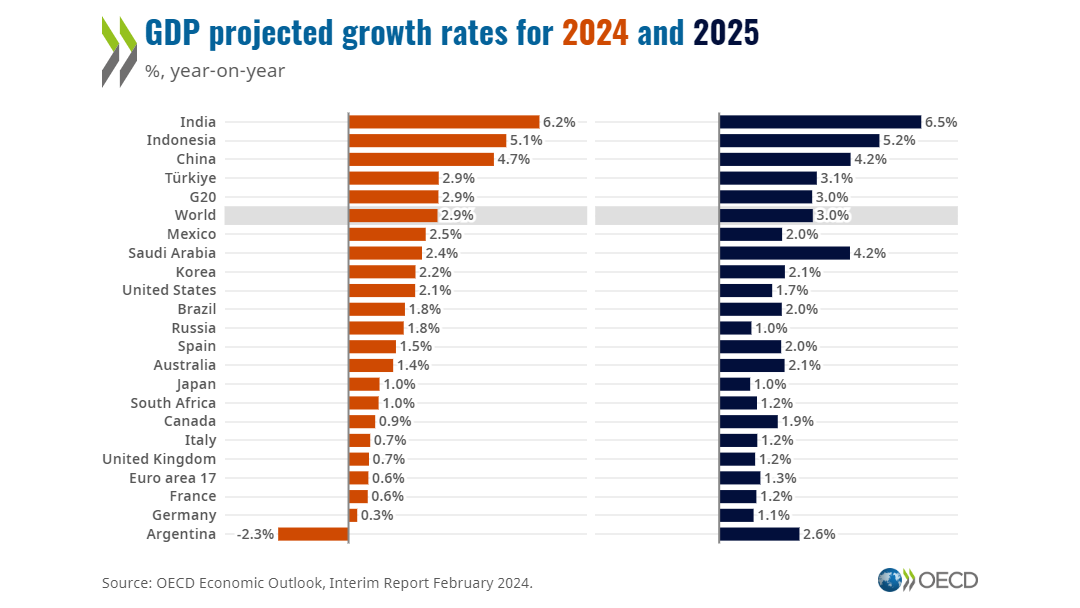

On a global scale, the OECD’s Economic Outlook in February 2024 projected relative weakness in Europe with global growth continuing to hover around the 3% mark throughout 2024 and 2025.

Source: OECD Economic Outlook, Interim Report February 2024

Against these growth rates, the UK continues to occupy the bottom of the list, with an expected 0.7% growth in 2024, rising very modestly to 1.2% in 2025.

So what does this mean for language service companies in the UK?

According to ELIS 2023 results, at the beginning of 2024, European language service companies remained positive, hoping to achieve an up to 10% rise in rates during the course of the year. Whether this hope materialises is up for conversation.

The next available data points for the UK landscape will come from the Nimdzi Insights 2024 UK Language Services Pricing Study, available to ATC member companies and survey respondents in late spring of 2024.

If you would like to stay in the know, benchmark your business against the industry, and contribute to our shared understanding of the language services landscape development, take the survey by Wednesday 10 April!