Global Horizons Showcases International Trade Insights in Collaboration with Leading Industry Bodies

The Association of Translation Companies is collaborating with the Chartered Institute of Export & International…

July’s ATC Coronavirus Pulse Survey gauges the effect of the coronavirus pandemic on payment practices, and takes a look at the sectors and services least affected.

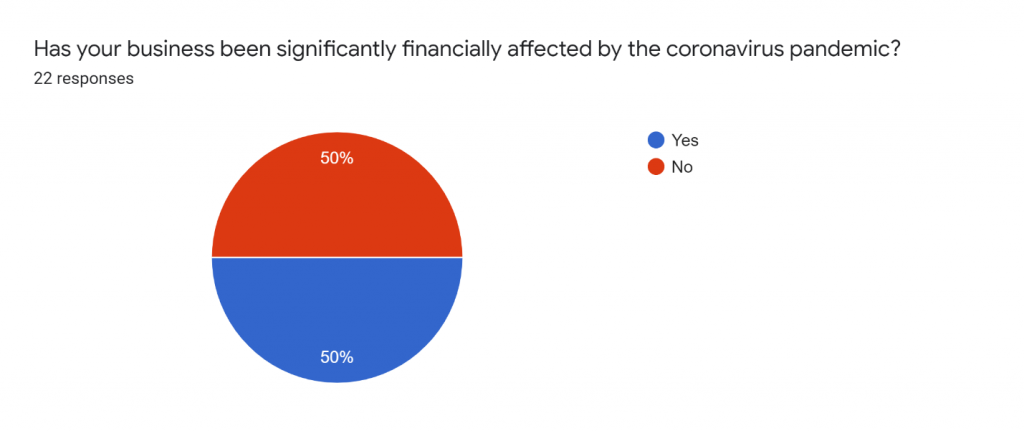

The July survey threw up a surprising new development: only 50% of the respondents reported having been significantly financially affected by the pandemic, compared to 73% in July and 65% in May.

However, as the July survey (perhaps due to pending summer holidays) only accounted for 22 respondents instead of the usual 45, it’s possible that this small sample slightly skewed the overall situation. With no survey going out in August, September Pulse Survey results will reveal whether this is on its way to becoming a trend.

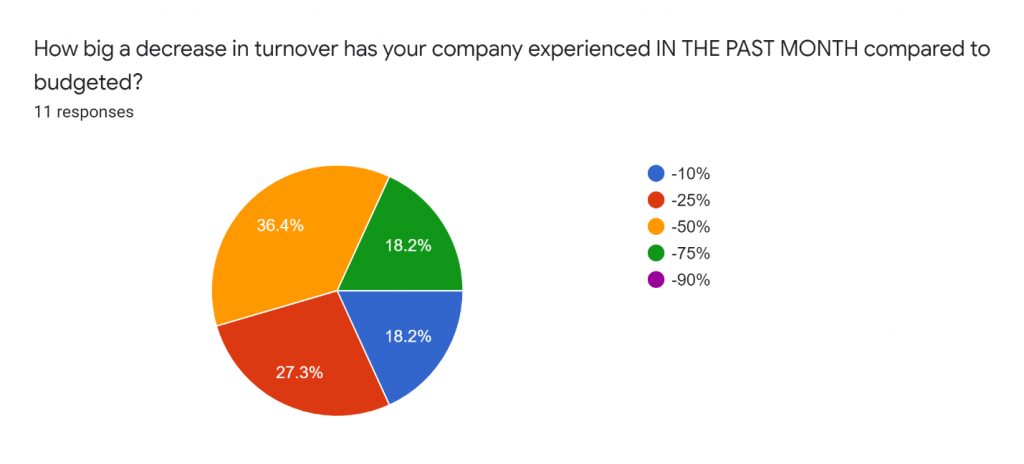

The earlier observed declining levels of decrease on turnover do seem to be a continuing trend for the past months, even with this small sample in July:

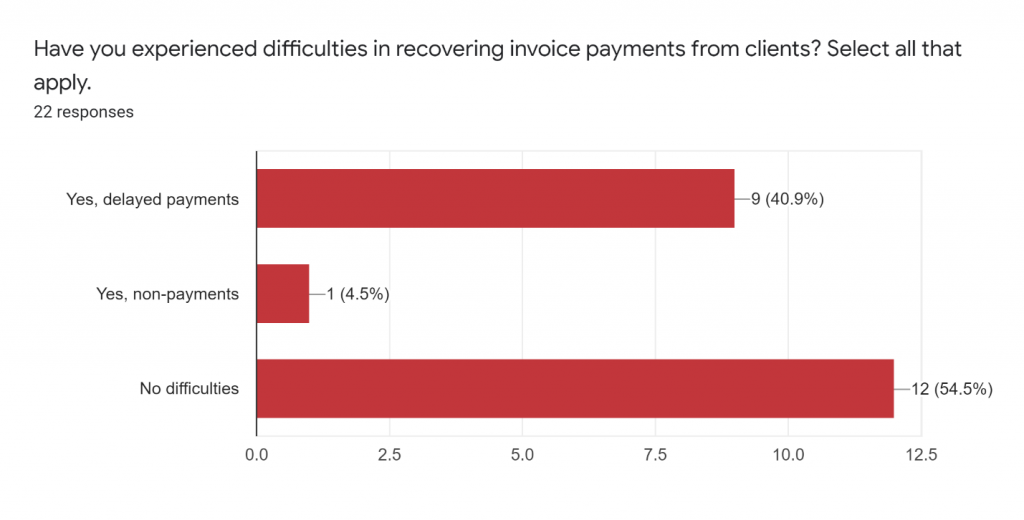

This month, we dug further into the effects of the pandemic on payment practices, both in terms of difficulties in recovering payments from clients, and in paying suppliers.

It’s modestly encouraging to see that over half of the respondents had had no difficulties in recovering payments from clients, even if this means that 41% had experienced payment delays. Only one respondent reported an issue with non-payments.

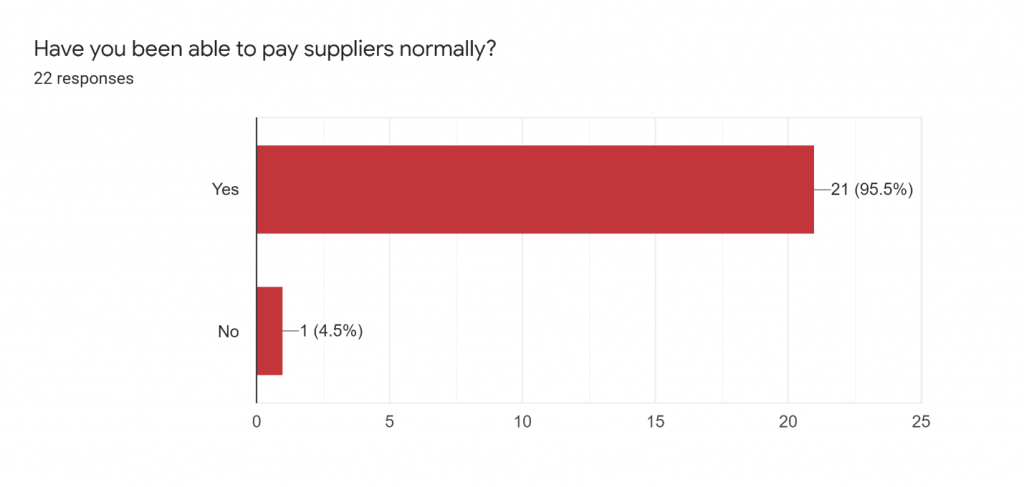

On a very positive note, all but one respondent had been able to pay suppliers normally, which indicates that language service companies have been able to manage cashflow without it affecting outgoing supplier payments.

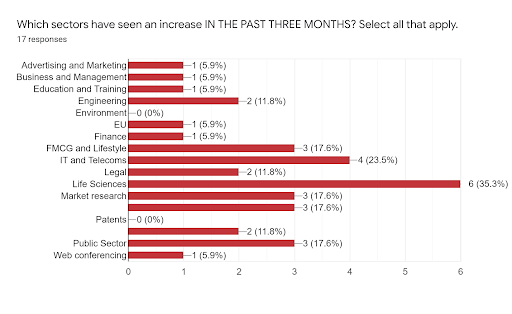

In the first Coronavirus Pulse Survey in April, we asked the industry about sectors and services that had seen an immediate decrease or increase following the onset of the pandemic.

Three months later in this July survey, we visit the sectors and services that showed the most potential to resist the pandemic’s business effects, or offered new opportunities.

In April, the sectors where more than two respondents reported an increase were Education and Training, IT and Telecoms, and Life Sciences.

In the past three months, this picture has evolved to mirror changing business priorities and online behaviours.

Three or more respondents reported an increase in the following sectors:

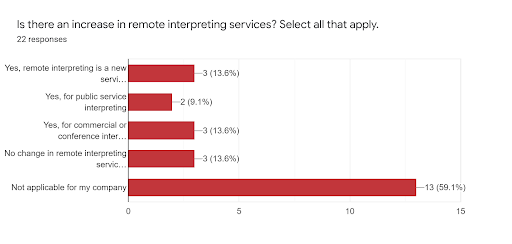

In terms of services, the April survey revealed a whopping 64% increase in remote interpreting services. In July, we returned to the question, and explored the development of remote interpreting services further.

It’s perhaps surprising that only 14% of respondents reported having started remote interpreting as a new service. However, the majority of respondents consider remote interpreting as not applicable for their company.

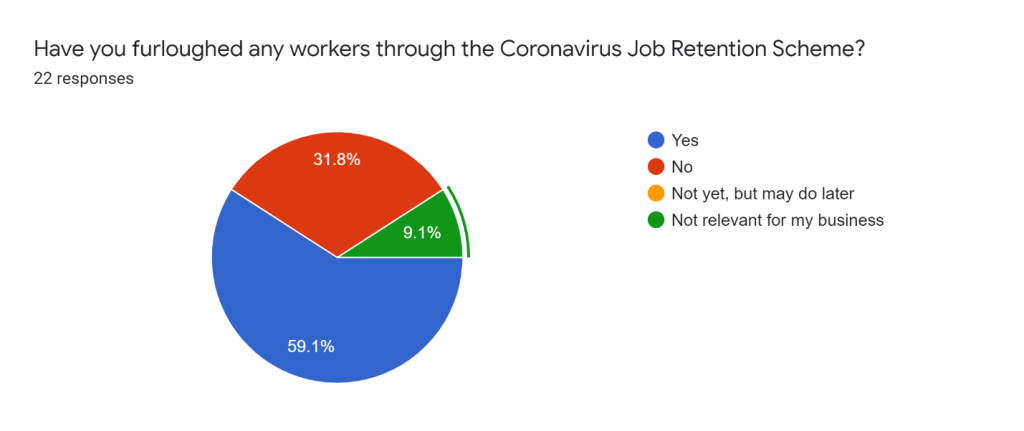

The UK Government’s Job Retention or “Furlough” Scheme provides a cash grant worth up to 80% of the salary of an employee who might otherwise be laid off.

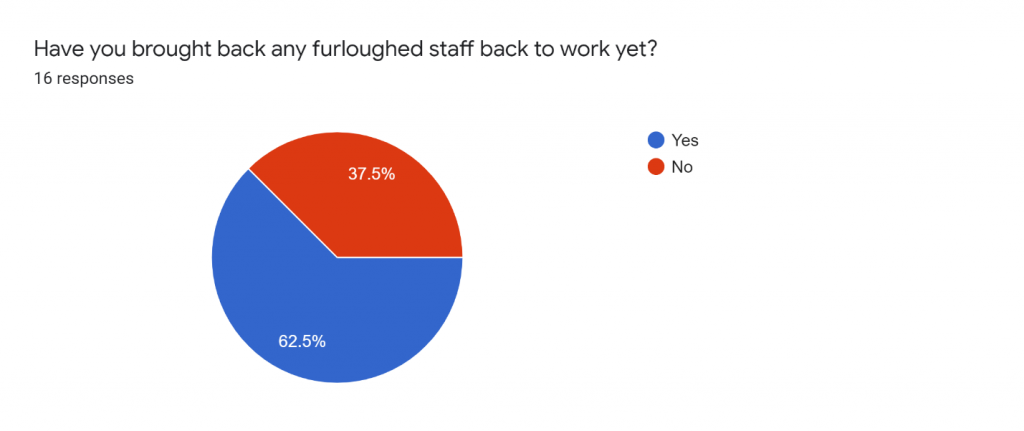

In July, 63% of companies had brought staff back from furlough compared to 32% in June, which indicates a certain increase in activity levels.

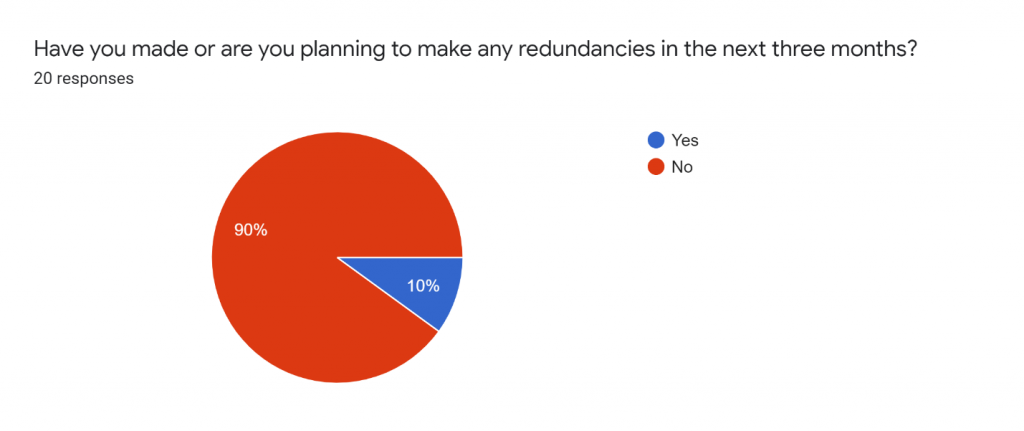

In line with June’s survey, the July survey indicates that only a small minority of companies are planning to make redundancies in the next three months.

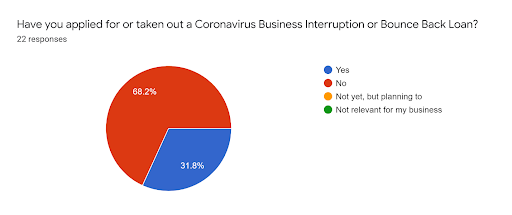

The level of business loan take-up also remains stable, with 32% having applied for or taken out a Coronavirus Business Interruption or Bounce Back Loan.

The next ATC Coronavirus Pulse Survey will go out in early September, in what remains an uncertain business environment.

September also signals the start to the last quarter of 2020, and the end of the Brexit transition period, which UK language service companies expect to bring both anticipated and unanticipated challenges and opportunities for business. To morph the Coronavirus Pulse Survey with Brexit Business Effect or not, what do you think?