To celebrate the ATC's 50th anniversary as trade association and community of language service companies,…

The third ATC Coronavirus Pulse Survey continues to chart the pandemic’s effect on the UK’s language service companies, but also looks ahead to the degree of positivity businesses have for the rest of 2020, as lockdown measures are lifted across Europe.

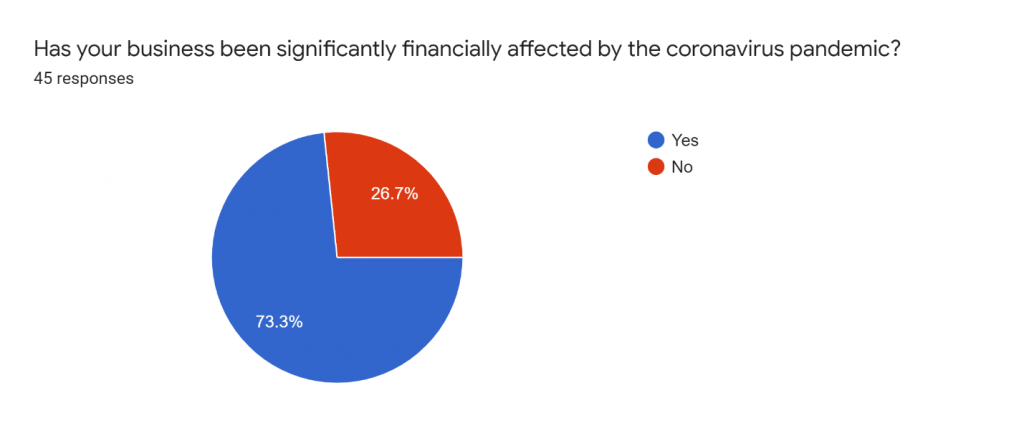

In the June survey, we again see clear evidence of the pandemic having an effect on more companies, with 73% significantly financially affected compared to 65% in May.

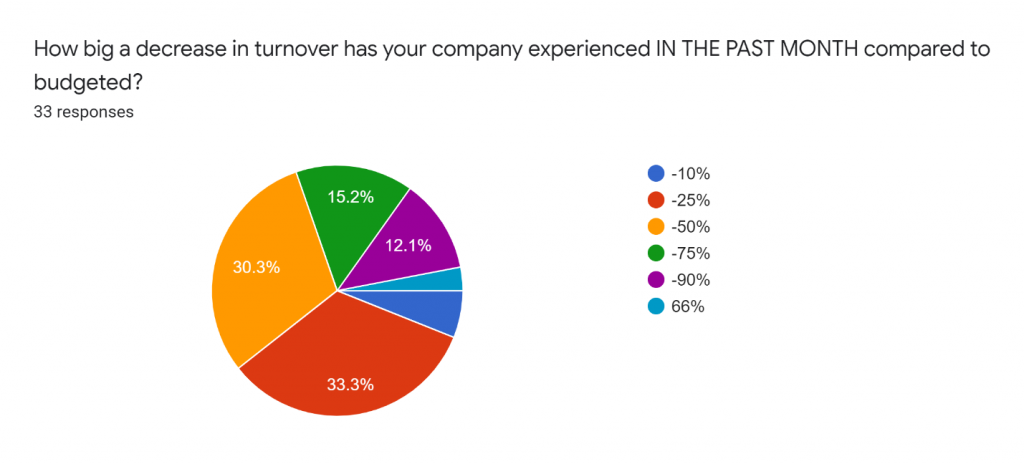

However, the decrease on turnover companies have experienced seems to be evening out, with considerable movement from the -50-70% bracket back to the -10-25% bracket.

This may indicate the start of gradual easing back into work, although the numbers themselves are of course still very sobering:

- 39% have seen a decrease in turnover of 10-25% (compared to 50% in April and 32% in May)

- 46% have seen a decrease in turnover of 50-75% (compared to 32% in April and 59% in May)

- 12% have seen a decrease in turnover of 90% (compared to 12% in April and 9% in May)

Looking ahead

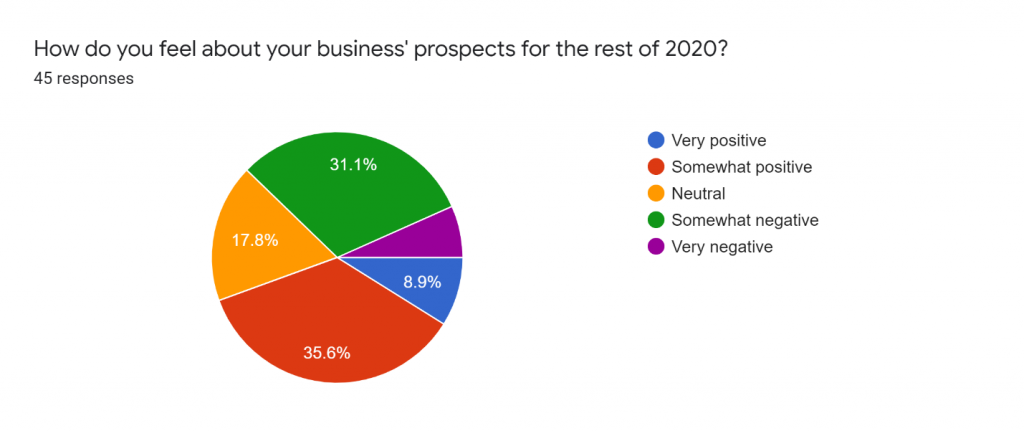

This month, we asked language service companies to look ahead into the rest of 2020 and assess how they felt about their business’ prospects.

What’s hugely encouraging is that 45% felt very or somewhat positive, and an additional 18% neutral, a testament to the resilience of the industry, perhaps. Only 7% of respondents felt very negative towards their business prospects in 2020.

We also asked businesses to share their views on the biggest opportunities and threats in 2020.

Opportunities

- Increased need for online engagement and new content being created

- New clients seeking out business opportunities

- Working in new or the right verticals

- Remote interpreting

- Focus on revised service offering

Threats

- Continued economic uncertainty and recession

- Decrease in client spending, low investment, long recovery period

- Price pressures

- Second pandemic wave and lockdown

- Brexit trade deals

Financial support

Furlough Scheme

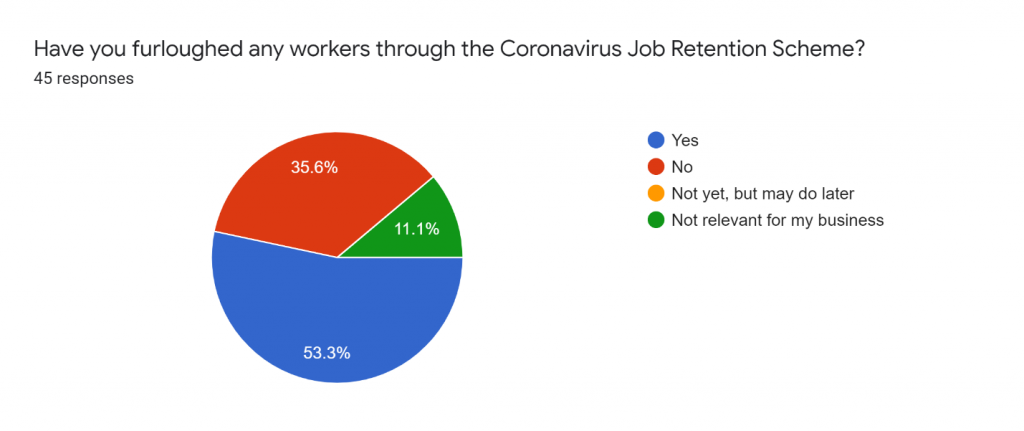

The UK Government’s Job Retention or “Furlough” Scheme provides a cash grant worth up to 80% of the salary of an employee who might otherwise be laid off.

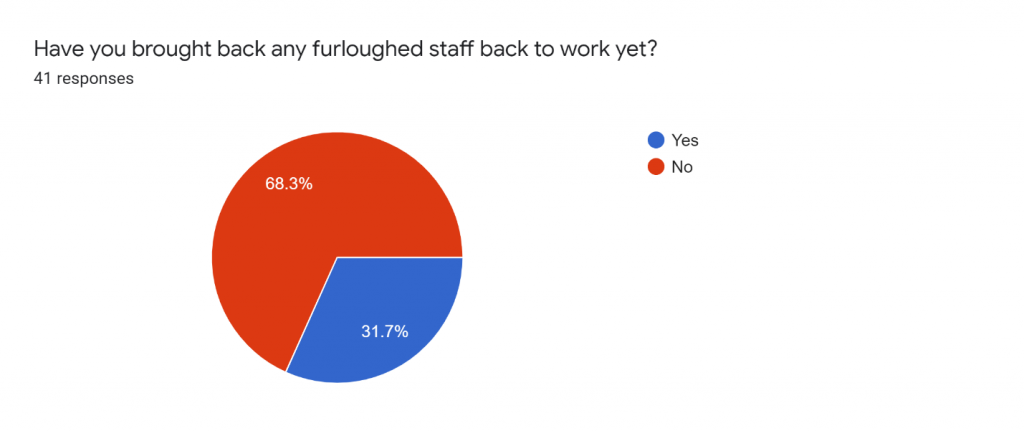

The number of companies with workers on furlough remained stable through May and June, with just over half of language service companies having furloughed staff.

In June, 32% of companies had already brought staff back from furlough.

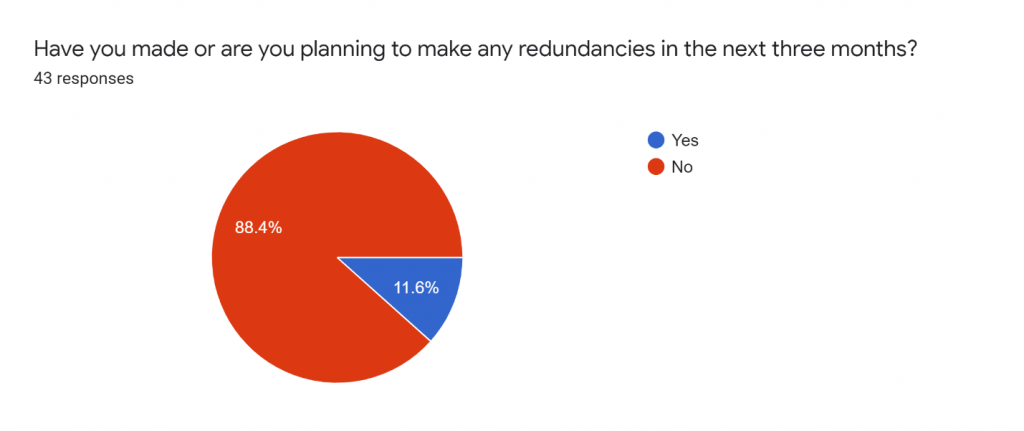

As well as figures on furlough, we asked companies whether they had made or were planning to make any redundancies in the next three months. The vast majority at 88% are not considering it – another positive sign.

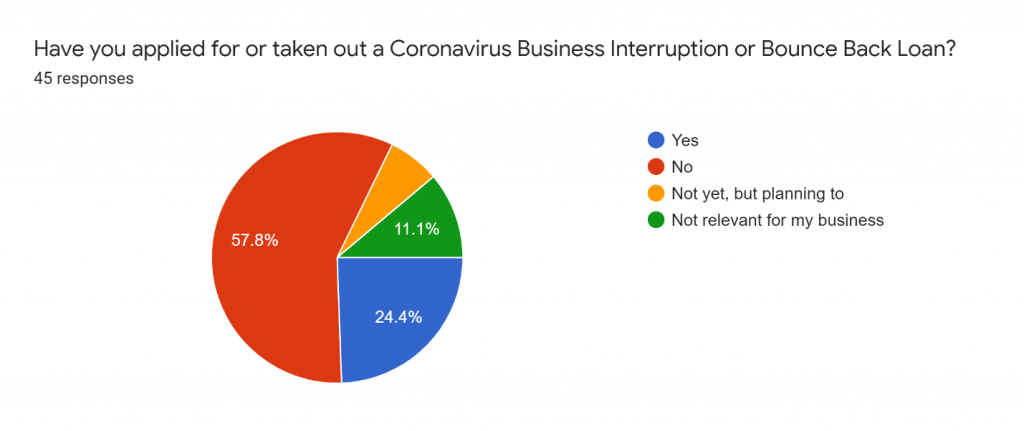

Business loans

Compared to May’s 23%, in June 31% of companies reported having taken out a coronavirus business support loan:

What next?

It will be interesting to continue to track the financial effect of the pandemic into July and August, traditional European holiday months.

In these next surveys, we may again take a snapshot of the client verticals and industries affected, or the effect of the pandemic in terms of world regions. We may also further dig into perceived pressures on pricing, and UK companies’ resilience and expectations of survival within the next 12 months.

Despite the major effect the pandemic has had on UK language service companies, there is clearly a significant degree of positivity and recognition of new opportunities amongst businesses.