Global Horizons Showcases International Trade Insights in Collaboration with Leading Industry Bodies

The Association of Translation Companies is collaborating with the Chartered Institute of Export & International…

The third ATC Coronavirus Pulse Survey continues to chart the pandemic’s effect on the UK’s language service companies, but also looks ahead to the degree of positivity businesses have for the rest of 2020, as lockdown measures are lifted across Europe.

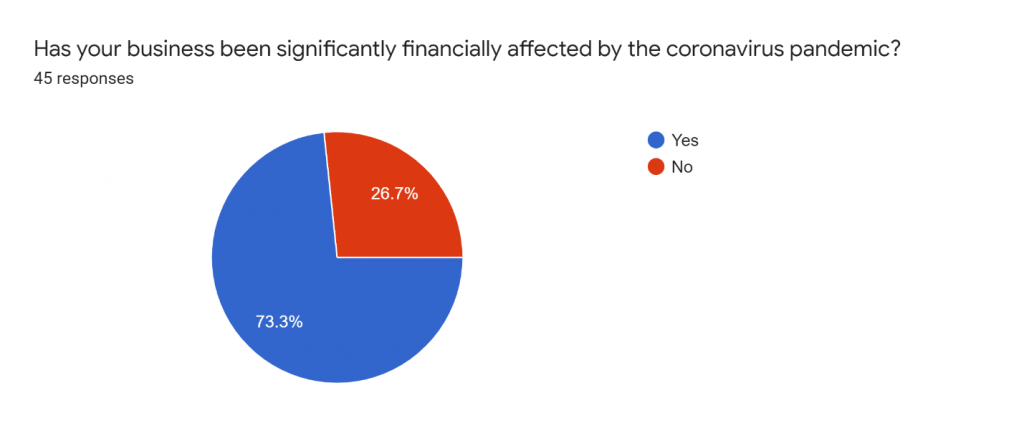

In the June survey, we again see clear evidence of the pandemic having an effect on more companies, with 73% significantly financially affected compared to 65% in May.

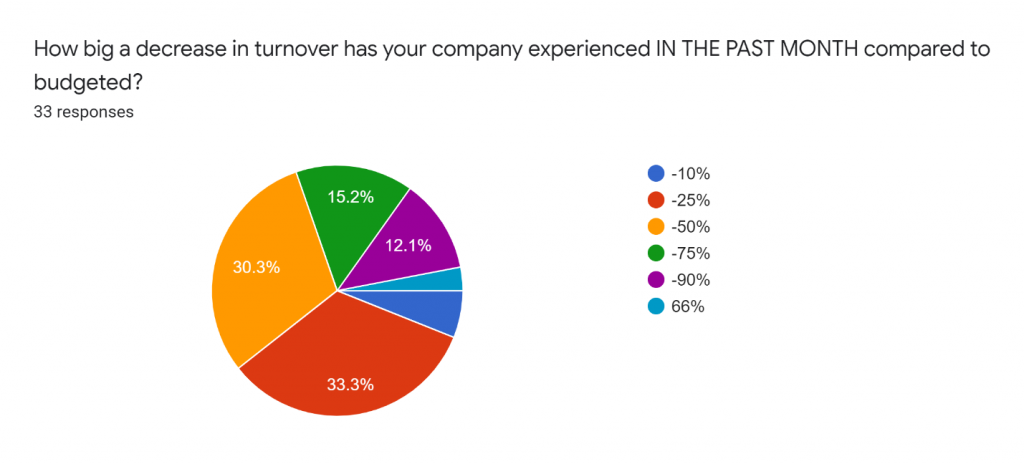

However, the decrease on turnover companies have experienced seems to be evening out, with considerable movement from the -50-70% bracket back to the -10-25% bracket.

This may indicate the start of gradual easing back into work, although the numbers themselves are of course still very sobering:

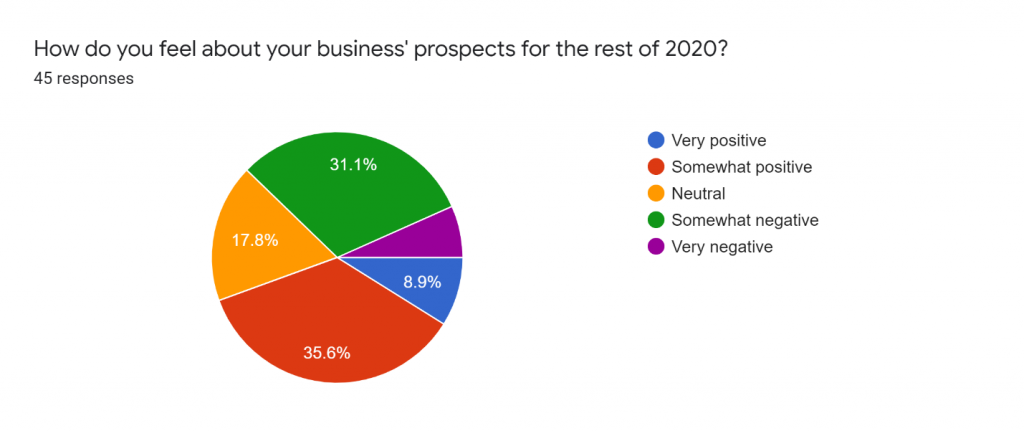

This month, we asked language service companies to look ahead into the rest of 2020 and assess how they felt about their business’ prospects.

What’s hugely encouraging is that 45% felt very or somewhat positive, and an additional 18% neutral, a testament to the resilience of the industry, perhaps. Only 7% of respondents felt very negative towards their business prospects in 2020.

We also asked businesses to share their views on the biggest opportunities and threats in 2020.

Opportunities

Threats

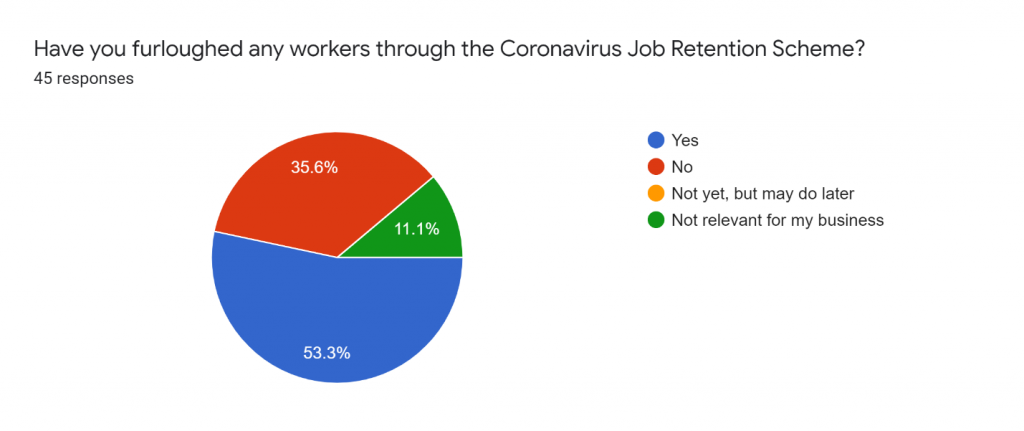

The UK Government’s Job Retention or “Furlough” Scheme provides a cash grant worth up to 80% of the salary of an employee who might otherwise be laid off.

The number of companies with workers on furlough remained stable through May and June, with just over half of language service companies having furloughed staff.

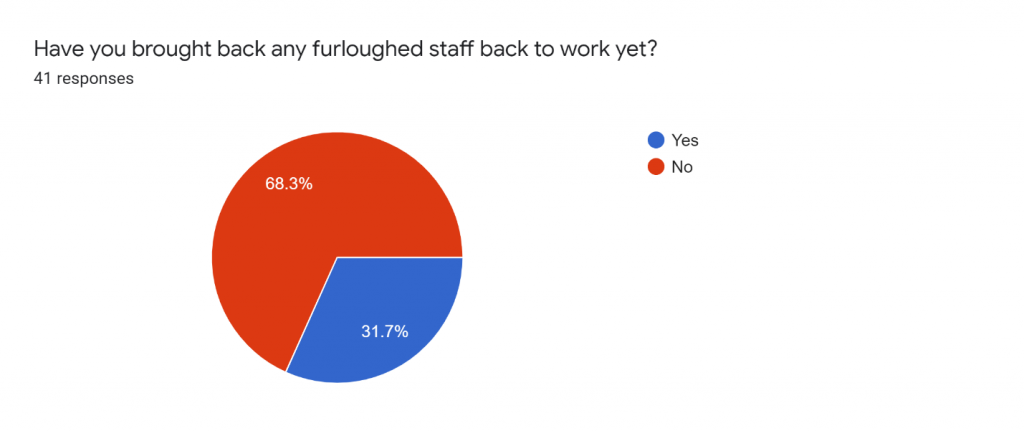

In June, 32% of companies had already brought staff back from furlough.

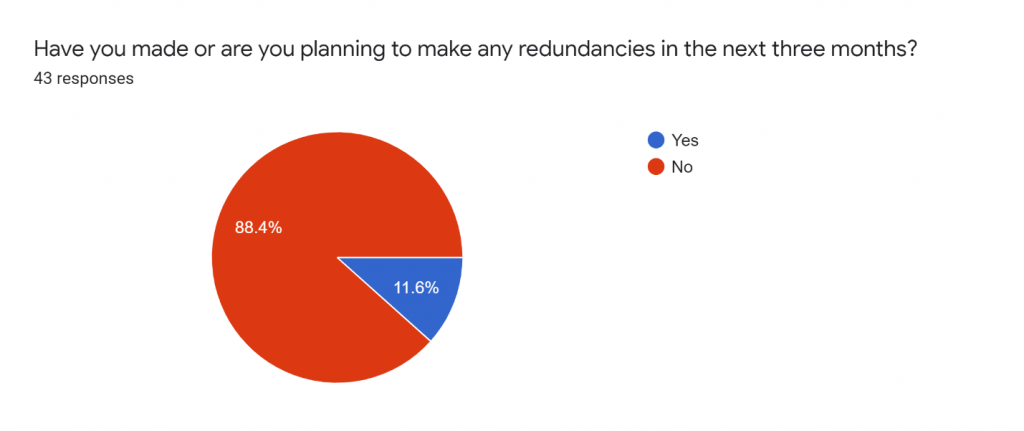

As well as figures on furlough, we asked companies whether they had made or were planning to make any redundancies in the next three months. The vast majority at 88% are not considering it – another positive sign.

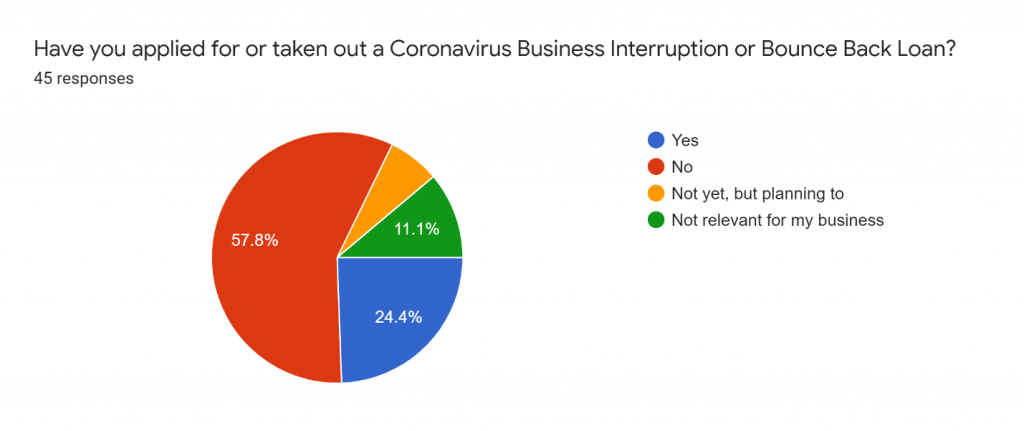

Compared to May’s 23%, in June 31% of companies reported having taken out a coronavirus business support loan:

It will be interesting to continue to track the financial effect of the pandemic into July and August, traditional European holiday months.

In these next surveys, we may again take a snapshot of the client verticals and industries affected, or the effect of the pandemic in terms of world regions. We may also further dig into perceived pressures on pricing, and UK companies’ resilience and expectations of survival within the next 12 months.

Despite the major effect the pandemic has had on UK language service companies, there is clearly a significant degree of positivity and recognition of new opportunities amongst businesses.