Global Horizons Showcases International Trade Insights in Collaboration with Leading Industry Bodies

The Association of Translation Companies is collaborating with the Chartered Institute of Export & International…

Two months into lockdown, the ATC’s Coronavirus Pulse Survey asks the UK’s language service companies how the pandemic has affected their business, and what financial support measures offered by the UK Government they have accessed. See the results of the first Coronavirus Pulse Survey here.

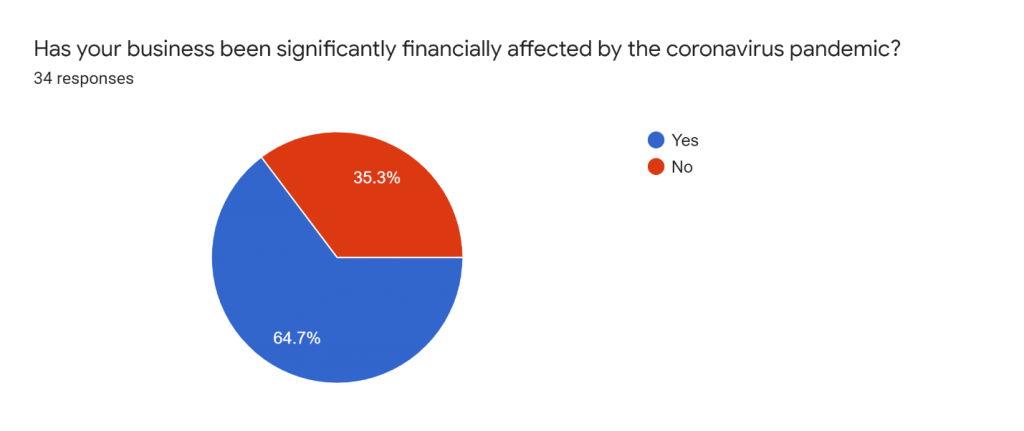

The May survey reveals that 65% of UK language service company respondents’ businesses have now been significantly financially affected by the coronavirus pandemic.

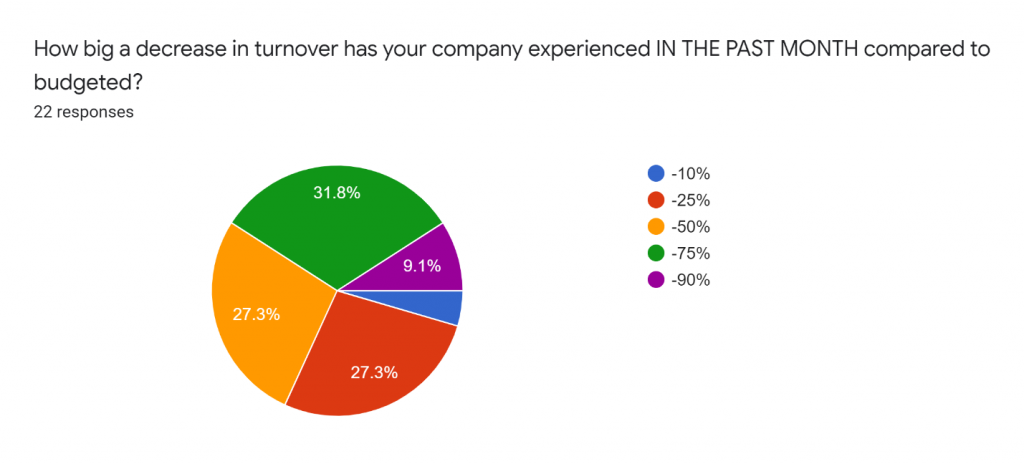

Compared to April, the first month of lockdown in the UK, the extent of the coronavirus business effect seems to be deepening:

On the other hand, over 35% of respondents replied that their business had not been significantly affected by the pandemic.

We gauged the reasons why these respondents believe their business has been shielded from the coronavirus business effect, and came back with a shielding contribution of diversification alongside sectors and verticals not affected by the pandemic:

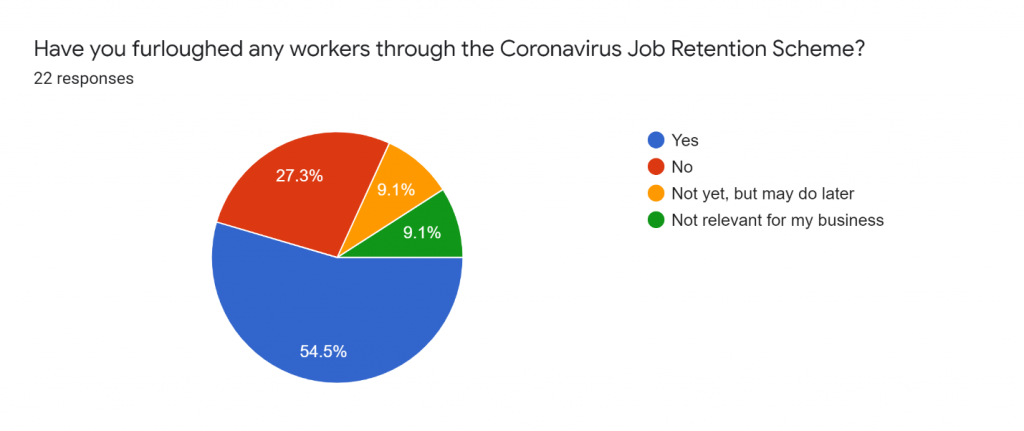

The UK Government’s financial support for SME’s includes a range of measures, and it seems that especially the possibility of “furloughing” staff has been amply used by language service companies in the UK.

The UK Government’s Job Retention or “Furlough” Scheme provides a cash grant worth up to 80% of the salary of an employee who might otherwise be laid off.

In April, 45% of language service companies have already furloughed staff. In May, the number of companies having furloughed staff has jumped by ten percentage points to 55%, and a further 9% are considering it.

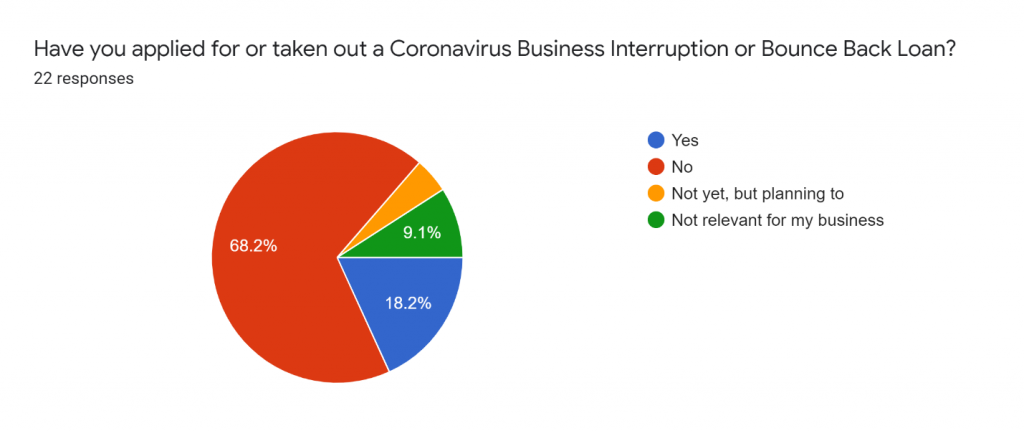

Alongside the original Business Interruption Loan, the UK Government released a new Bounce Back Loan specifically aimed at SME’s.

By mid-May, 23% of respondents had either taken a business loan or were planning to:

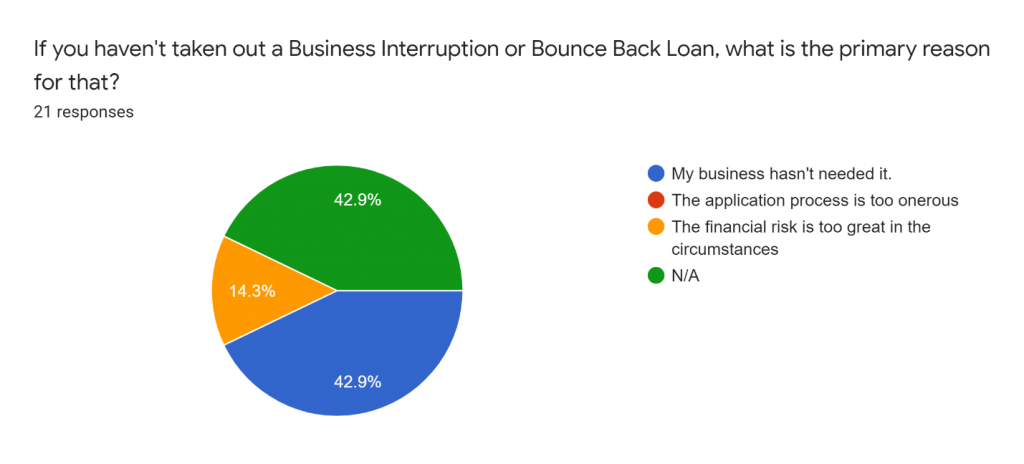

For the majority of businesses who hadn’t taken a loan, the primary reason for it was that the business simply had not needed it. On the other hand, 14% had not taken out a loan because they deemed the financial risk too great in the current circumstances.

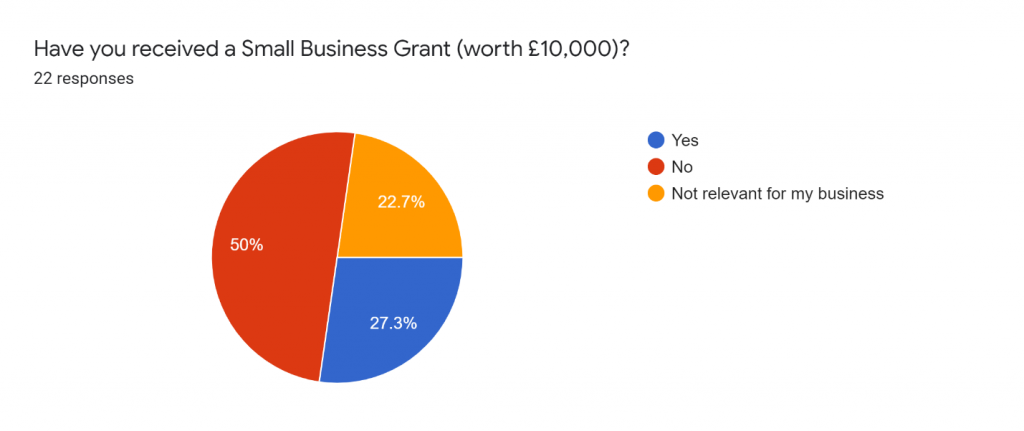

The number of businesses receiving a Small Business Grant worth £10,000 remained at a steady 27%, with half of the respondents not having received one.

As the lockdown measures in the UK are slowly starting to be lifted, respondents reiterated the need for continued Government lobbying, regular surveys and sharing of industry-related guidance.

Many wanted to drill down into further coronavirus effects, for example, on sales prices and the degree of positivity for businesses post-lockdown, and we will look into these in the next survey. Some highlighted the dangers of bad debt as a significant problem as businesses continue to struggle with cashflow.

What is clear is that there is a growing gap between companies feeling the full weight of the pandemic on their businesses, and those not having experienced a significant financial effect. Our June Pulse Survey will continue to track the developments within the UK’s language services industry.