Global Horizons Showcases International Trade Insights in Collaboration with Leading Industry Bodies

The Association of Translation Companies is collaborating with the Chartered Institute of Export & International…

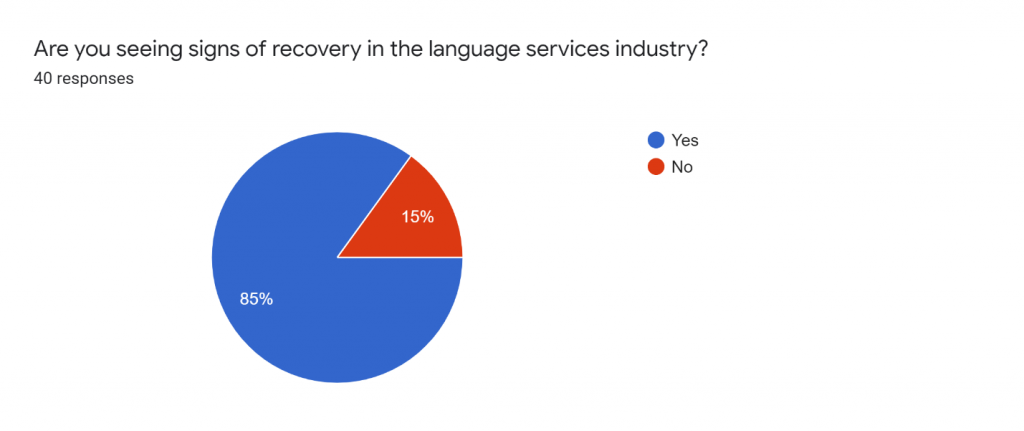

The ATC’s September Coronavirus Pulse Survey confirms anecdotal evidence from SME language service companies in the UK: a large majority is seeing signs of recovery.

Earlier Pulse Surveys tracked the deep and immediate impact of the coronavirus pandemic on the UK’s language service companies, and a slow but steady easing off through the summer months. In this September Coronavirus Pulse Survey, we asked language service companies whether there really were signs of recovery, and if so, what and how strong.

Out of the 40 UK language service companies responding to the September Pulse Survey, 85% are seeing signs of recovery in the language services industry.

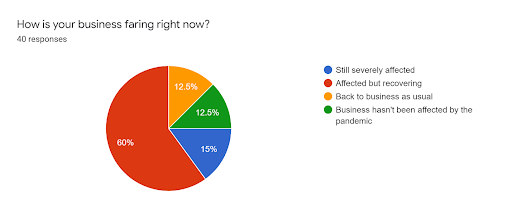

What’s more, business for most seems to be picking up. Well over half, 60% of respondents, reported their business being in recovery, 12.5% were back to business as usual, and 12.5% reported that their business had not been affected by the pandemic. Only 15% reported that their business is still severely affected.

Respondents’ free text answers on particular signs of recovery and their strength refer to old clients returning but also to new opportunities:

A sure sign of business picking up is also the reactivation of recruitment activities. Andrew Jones, London-based European Team Lead at Adaptive Globalization, is seeing a clear uptick in new roles in the localization industry compared to the spring,

“We have seen a clear increase in recruitment within the industry especially over the last few months with most of our clients returning to business as normal.

We have seen the number of jobs we are working on rise over 700% when comparing July-August to May-June this year and leaving us only 2 jobs behind where we were this time last year for number of active roles across that period.”

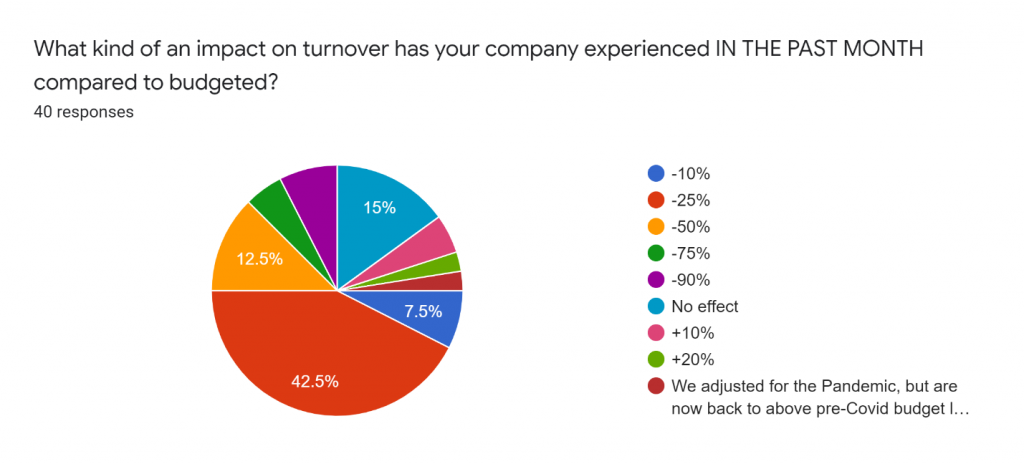

The deep impact on turnover many companies have experienced has slowly been easing off over the summer months, with more companies reporting less of an impact and some even an increase in turnover. However, a quarter of all respondents still reported a decrease in turnover of over 50%.

Compared to budgeted revenue in the past month,

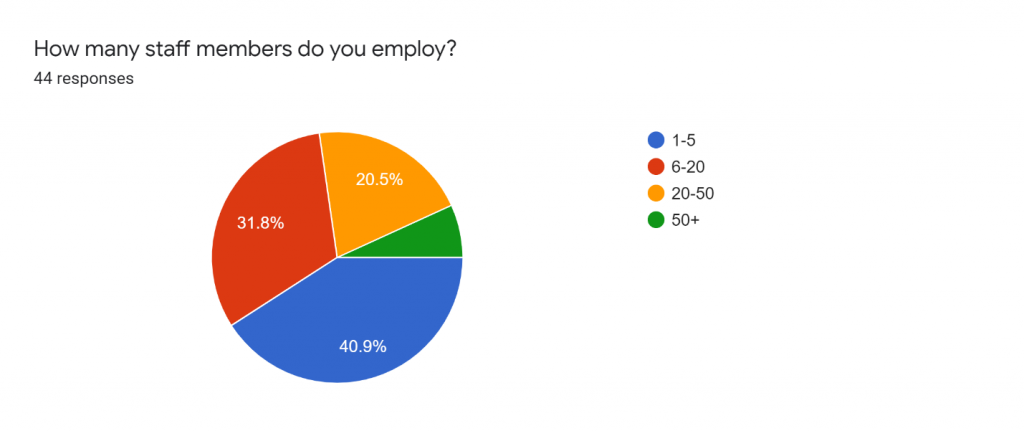

This month, we also asked respondents how many staff members they employ. As expected, the distribution echoed the ATC’s membership primarily consisting of SME companies.

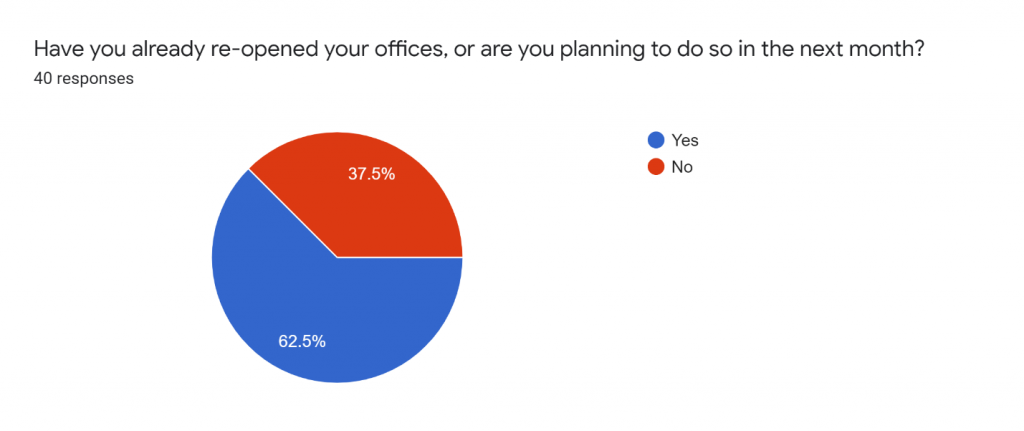

In the middle of a national campaign to return to offices, a majority of language service companies have already re-opened their offices or plan to do so shortly. It pays to note, however, that the very real possibility of a second wave in the UK may slow this process down considerably.

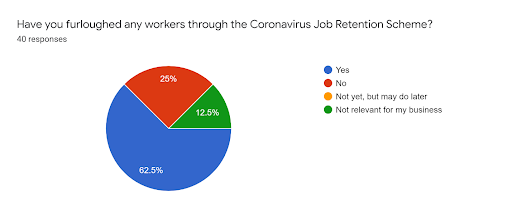

The UK Government’s Furlough or Job Retention Scheme which provides financial support to companies for continuing to employ their staff has now been extended until the end of October 2020.

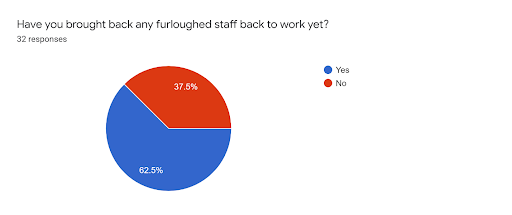

In the September survey, 62.5% of companies reported having made use of the scheme, and out of these 25 companies, 20 had already brought furloughed staff back to work – a positive development.

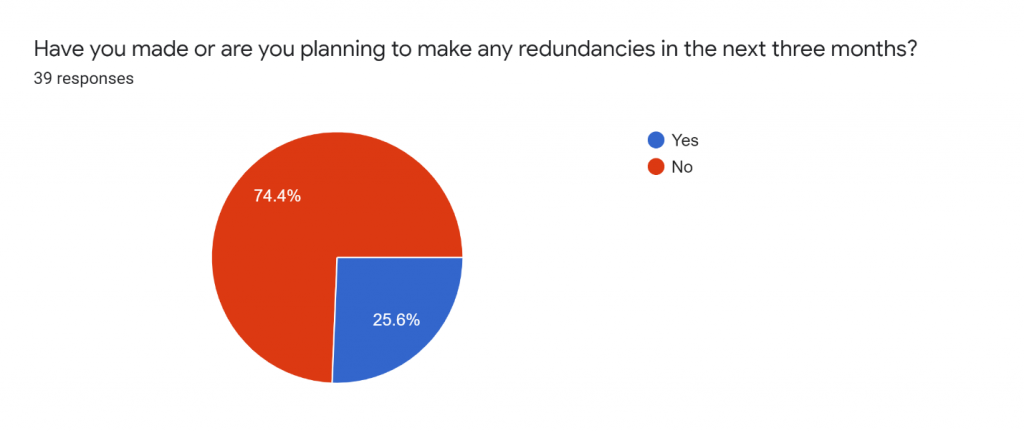

However, more redundancies may be in line, as 26% of companies have already made or are planning to make redundancies in the next three months, compared to 10% in previous months.

From October 2020, the ATC Coronavirus Pulse Survey will transform into the ATC Pulse Survey. For the last quarter of 2020, the Pulse Survey will track not just the impact of the coronavirus pandemic, but also the implications the end of the Brexit transition period brings.