Global Horizons Showcases International Trade Insights in Collaboration with Leading Industry Bodies

The Association of Translation Companies is collaborating with the Chartered Institute of Export & International…

The word on the street is that business is not good, that the economic downturn is making itself felt at language service companies, and that clients are scaling down on budgets – or putting content on hold as they try to figure out their options around AI.

Is this true for everyone? What exactly is going on in language services, and how fast is the landscape moving? How are SME language service companies weathering yet another crisis? Where does your company fit in all of this?

The ATC’s business review looks back on the past years’ trends, and opens up live tracking for today’s developments.

TAKE THE NOVEMBER BUSINESS CONFIDENCE PULSE NOW

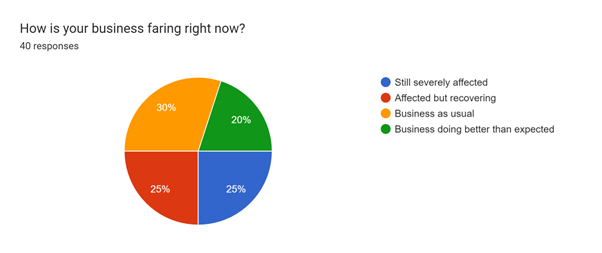

In January 2021, the UK’s language services industry was in recovery from the disruption caused by the COVID pandemic and Brexit. Over the course of the previous months, the ATC had taken the industry’s pulse on a monthly basis, tracking the impact of the challenges faced by language service companies. At the time, the discrepancies were clear: half of the UK’s language service companies reported business as usual or doing better than expected, and the other half reported business either still severely affected or affected by recovering.

Source: ATC Corona & Brexit pulse January 2021

Source: ATC Corona & Brexit pulse January 2021

In late 2021, the ATC UK Language Services Industry Report surveyed the extent of the damage: Almost 60% of UK language service companies had lost business due to the pandemic, and nearly 50% reported worries over future effects of Brexit.

But the 2021 report also saw clear bright light at the end of the tunnel: more than half of UK language service companies recorded positive growth, and the overall market for language services in the UK was growing.

Two years later, in the 2023 ATC UK Language Services Industry Report, the majority of companies reported above-average growth as the industry returned to full swing with an impressive growth rate of 15.5% in 2021, and 12.5% in 2022 as the industry recovered and rebalanced – an impressive feat considered against the median industry growth rate of 5%.

The 2022 data showed strong growth rates in the UK market: financial benchmarks were trending in the right direction, the rates were up, UK LSCs were bucking the worldwide trend of hiring less and expanding their activity, and adding more technology into the mix.

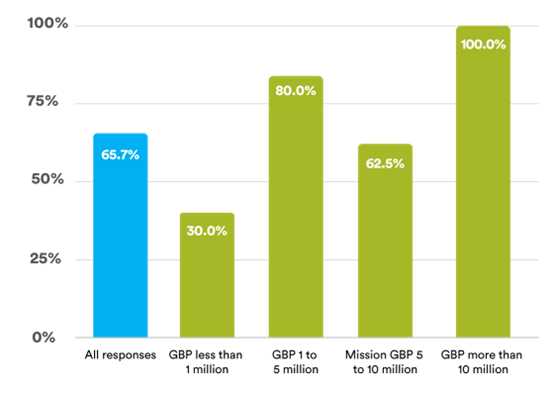

What was different in 2023, however, was the emerging net growth rate gap between micro companies with less than £1 million turnover, and everyone else.

The ATC UK Language Services Industry Report figures were clear: smaller companies were hit hardest by the unpredictable economy over the previous two years. Where 80% of companies with revenue above £1 million experienced net positive growth in 2022, just 30% of companies with revenue less than £1 million had the same fortune.

Source: ATC UK Language Services Industry Survey and Report 2023

And then came 2023, with continued economic pressures, inflation, and the cost of living crisis.

As the 2023 report came out of the press, the entire language services industry was in wait-and-see mode. 2023 half-year results of some of the largest companies in the industry indicated flat growth, and LSCs of all sizes were reporting projects being put on hold as localisation departments on the client side saw their budgets stagnate or increase only modestly. As always, the language services industry acted as a rapid gauge for national and global economic developments.

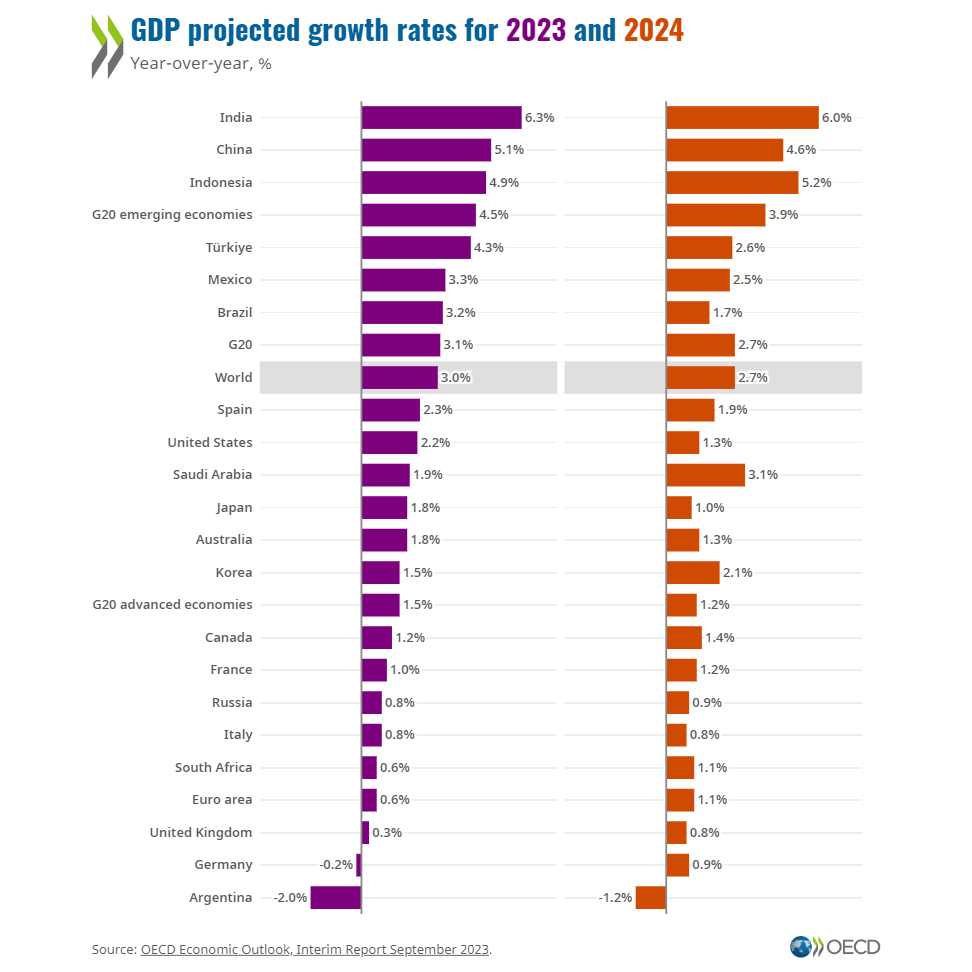

In 2023, an economic recession has replaced the global pandemic, and geopolitical uncertainty and the rising cost of living impact directly on language service companies’ business. The OECD’s Economic Outlook from September 2023 confronted the prospect of continued low growth in 2024, with UK GDP growth rates worse than most, projected for 2023 at 0.3% and 0.8% for 2024.

What does this mean for language service companies?

In the UK’s language services industry, and on a wider European scale, the word on the street in late 2023 is that business is not great. But what exactly is going on, where exactly are we heading, and how fast?

Is the language services industry heading into a serious downturn, with clients scaling down on budgets, putting projects on hold, and waiting for AI-driven solutions to boost their global reach? Are we talking about a short-term blip in our collective fortunes, or are we heading into something more serious? Where are SME language service companies in all of this? Where’s your company in all of this?

Nearly three years have passed since the ATC’s monthly business impact and confidence pulse was put on hold – and today it’s time to start taking it again.

The ATC’s new Business Confidence Pulse tracks the impact of industry challenges to ATC members’ businesses and the industry community around them, live and in real time, set against the industry benchmarks.

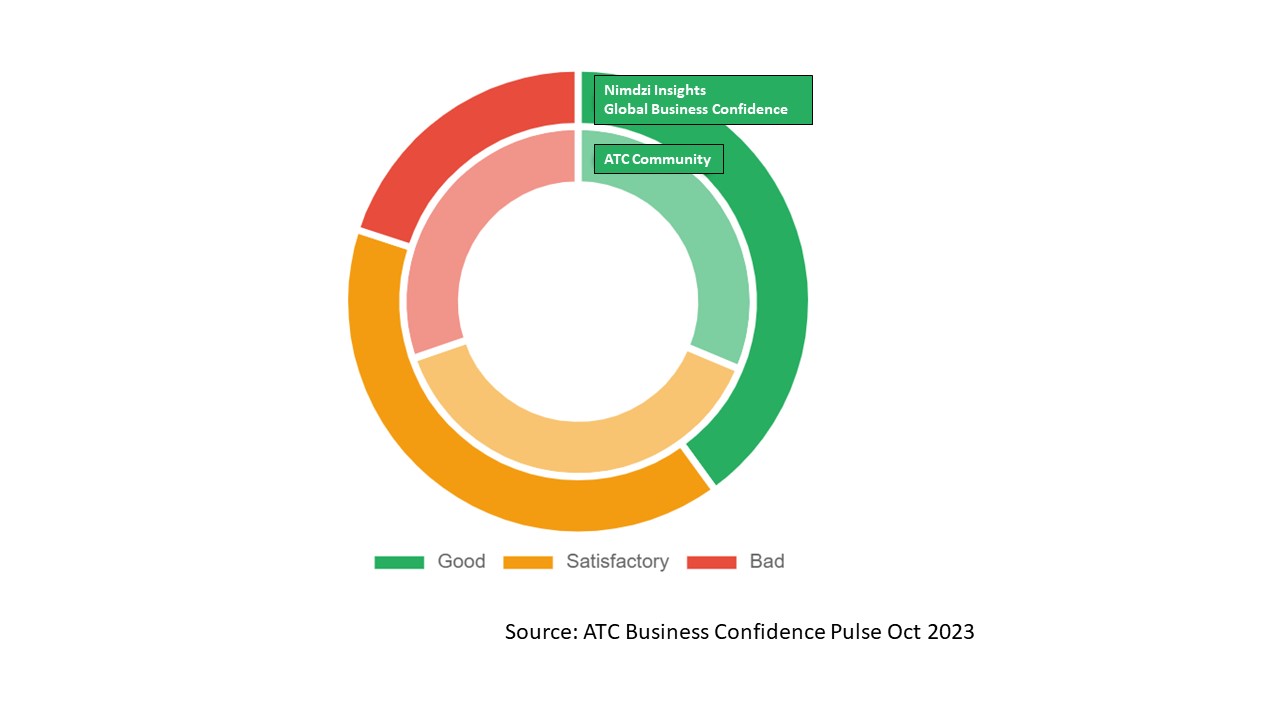

In October 2023, the first small-scale iteration of the ATC Business Confidence Pulse recorded a landscape where the UK’s SME landscape still appeared somewhat resilient compared to Nimdzi Insights’ Q1-Q2 2023 global business confidence survey including both buyer-side and LSC data.

For nearly 70% of respondents, business is good or satisfactory. But that still leaves a fifth of respondents for whom business is bad.

In this early mood board, especially notable is the low level of confidence in business, expressed by the pale colour gradient in the ATC Community’s responses. Despite business being OK for the majority, there is little confidence in the current climate of it remaining so.

Beyond the global headlines and AI hype, how’s your business doing right now, and what’s your level of confidence in the future?

In the November 2023 ATC Business Confidence Pulse Survey, we ask UK-based language service companies what their biggest challenges are right now, and how confident they feel in tackling those challenges.

Help us see the bigger picture, and compare your landscape to the community around you, live in the survey tool. Take the November Business Confidence Pulse now!