The ATC’s October Pulse Survey combines UK language service companies’ experiences on the effects of the continued coronavirus pandemic, and the looming but still uncertain impact of Brexit. It’s a mixed bag, with continued signs of recovery but significant unease over the future.

Business right now

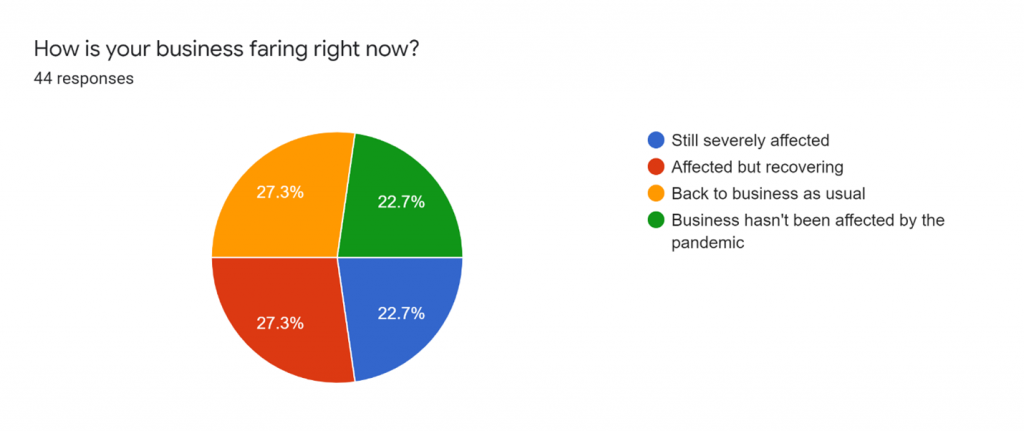

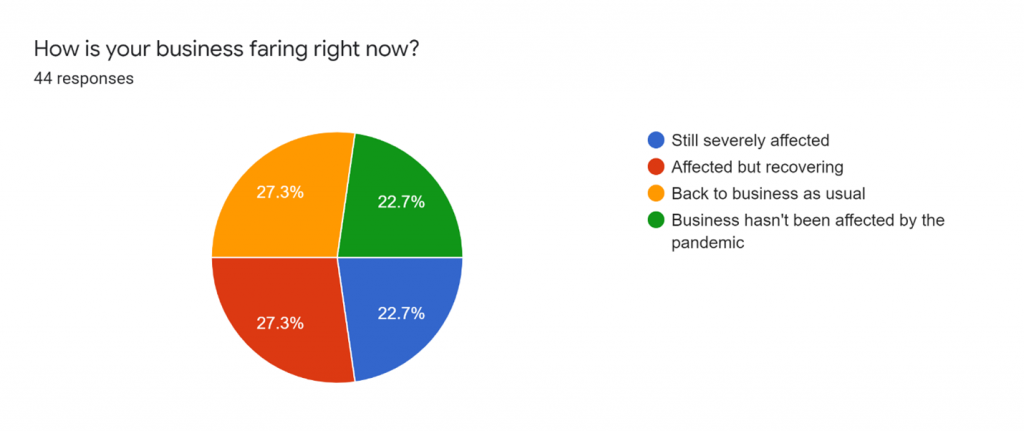

UK language service companies’ business landscape continues to evolve, and it’s clear that the experience of the pandemic’s effects is very different from one company to another.

In this October survey, exactly half of the respondents reported business as usual, or business not having been affected by the pandemic.

The other half reported having been affected but recovering, or still being severely affected.

When asked about the impact on turnover experienced by the company in the past month compared to budgeted, 57% reported a range from -10% to +10%.

On the flipside, 25% of respondents still reported a decrease in turnover ranging from -90% to -50% compared to budgeted.

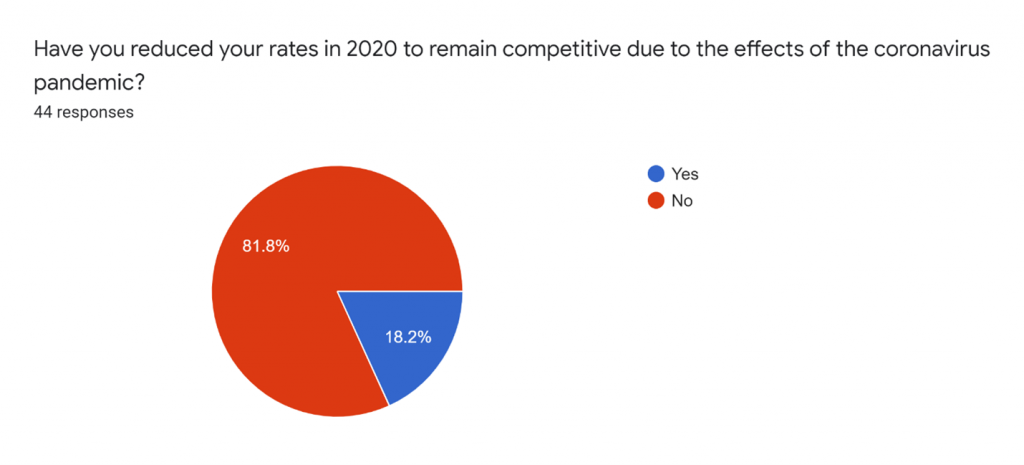

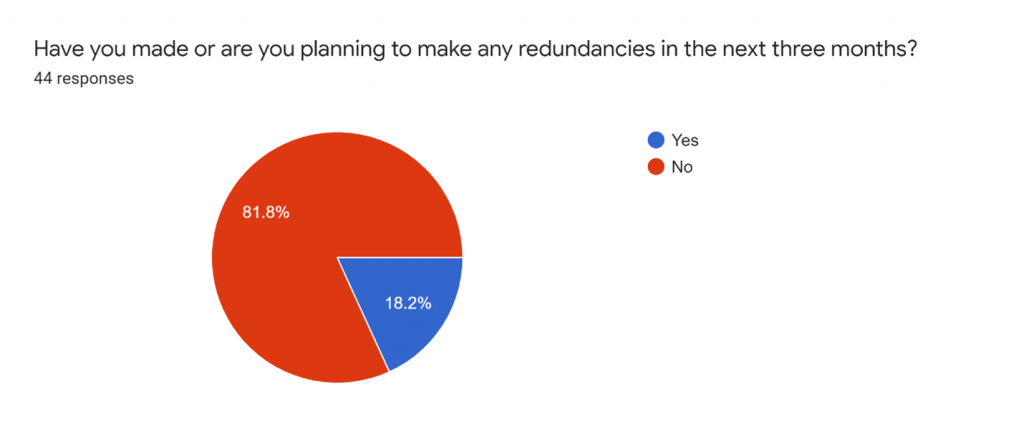

Reactions to rates and staffing levels

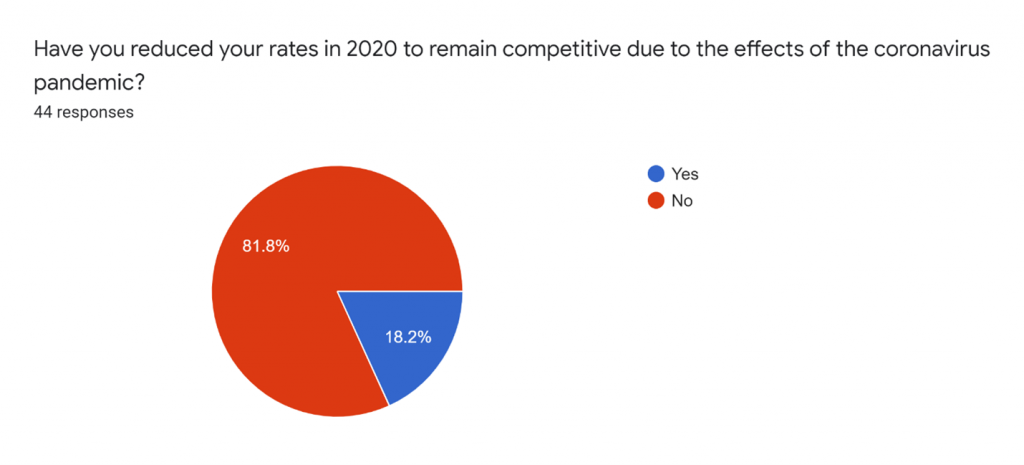

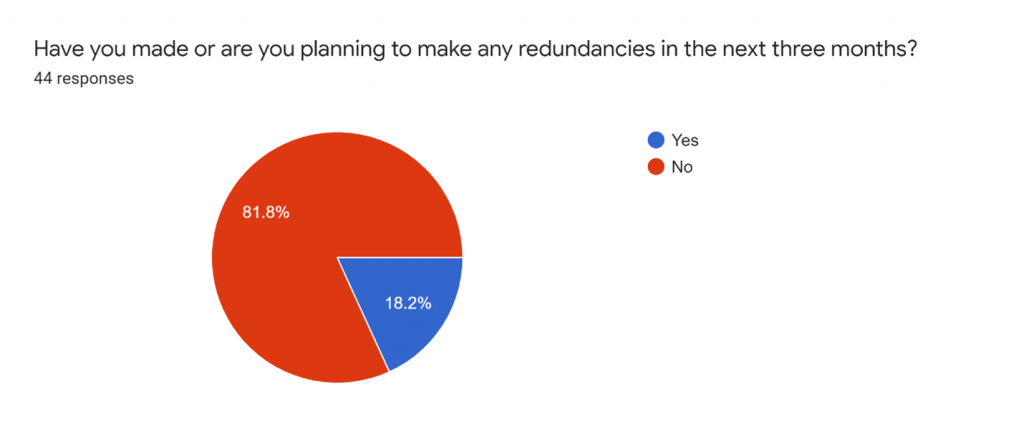

This month, we gauged the respondents’ business activities by asking whether they had reduced their rates in 2020 to remain competitive due to the effects of the coronavirus pandemic, or made or were planning to make redundancies in the next month.

An overwhelming majority of 82% responded that they hadn’t reduced rates or made or planned redundancies.

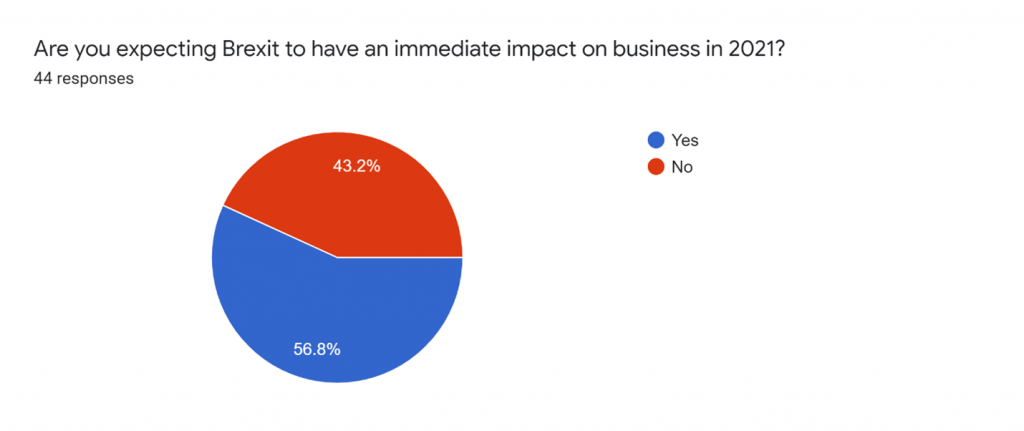

Brexit and business

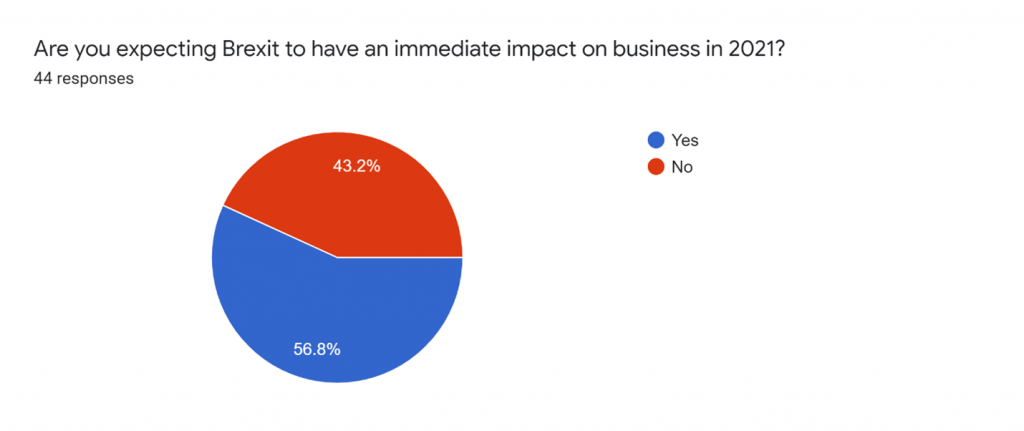

With just over two months until the end of the Brexit transition period, and a deal or no deal between the UK and the EU, 57% of respondents were expecting Brexit to have an immediate impact on business in 2021.

What are the challenges?

Respondents’ free text answers on Brexit challenges paint a picture of changing trade with fears over EU clients’ potential reluctance to buy from the UK. The respondents also report concerns around recruitment, data privacy and banking, among others. And, of course, uncertainly around what trade will look like exactly in January 2021.

- UK companies being reluctant to export goods or reducing their markets this requiring less localisation.

- VAT, doing business with the EU etc. The main challenge at the moment is the lack of information. No one is able to tell us exactly how to prepare and what will change.

- Data privacy rules, combination of Brexit and COVID leading to additional stresses on businesses, recruitment of foreign nationals.

- Possibly having to charge VAT to EU clients, thus making us less competitive (20% VAT). Also, the upset and dislike towards English people and therefore English companies that has been generated by Brexit, is influencing European-based clients away from English service providers. They would rather stick with European-friendly providers. Then we have EU institutions potentially not being able to outsource translations to non-EU translation companies. This is forcing us to set up an additional business entity in Europe with all the associated costs involved (very difficult after the financial meltdown generated by the COVID lockdown and the economic uncertainties generated by possible future lockdowns). So, we are hit on both fronts, COVID and BREXIT.

- Tariffs: If we have to charge tariffs on top of our rates this will be detrimental. There is already a lot of pressure to reduce our rates. Tariffs on top means clients will go elsewhere to competition on the continent.

- Banking: Will charges be increased for international banking e.g. when paying a supplier in France for a translation from English into French for one of our UK clients.

- Free movement and Erasmus students/University exchanges: Erasmus students were a key part of our business for many years. They offered us valuable language expertise in return for work experience, a chance to improve their English language skills and experience of the British culture.

- A drop in demand for translation: Since much of what we translate is for manufacturing companies selling into the UK, if we are less attractive to the EU as a country with which to do business, then this will reduce the demand for translations into English.

- Retail market regulation – making choice work; Mobile roaming; Data protection and privacy; Future services, future opportunities; State Aids – will the UK still be on the EU level playing field?; Local Government/municipal broadband; Labour market; Consuming digital products – rights, price, choice, delivery; Regional digital economy strategy (payment practices)

- Staff recruitment in UK

- Our clients will be finding it harder to sell into the EU, therefore less work for us. We worry that our own clients in the EU will be less inclined to buy from UK.

- Greater reticence for businesses to spend money on translation when they are uncertain of their own future, Non-UK based business may be more likely to reach out to non-UK based LSPs for their requirements (in the perception that it’s easier), increased difficulties in attracting interns or staff, potential increased costs if tax/VAT concerns are not addressed which will reduce financial competitive abilities, impact on US clients – reduced desire to see UK as gateway to Europe therefore dealing directly with European-based LSPs for their translation needs.

- Accessibility to EU agency business; Data transfer and privacy

- Overall economic decline, cost pressures due to weaker GDP, less goodwill towards / worse international standing of UK companies, added bureaucratic headaches.

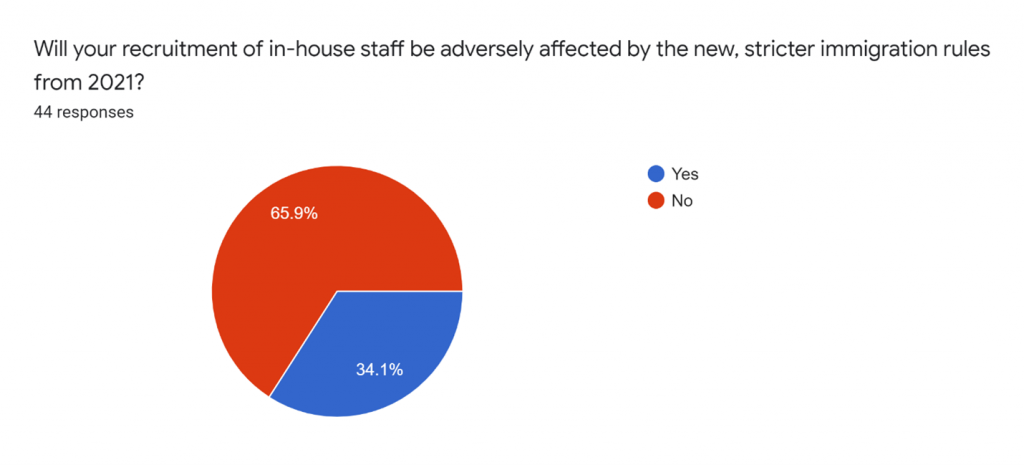

Brexit and Immigration

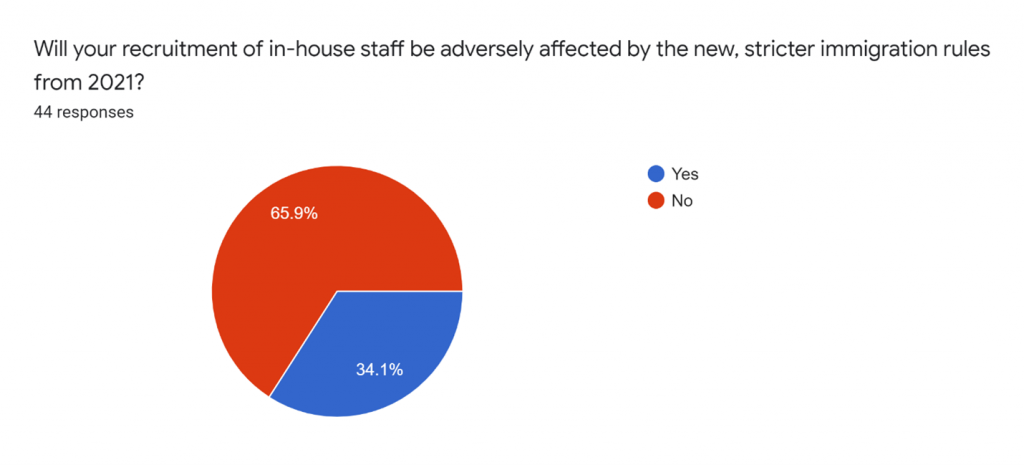

We also asked the respondents whether their recruitment of in-house staff would be adversely affected by the new, stricter immigration rules from 2021.

A significant minority, just over a third, responded yes. However, only 9% had already or were planning to register as a “sponsor” with the Home Office to be able to recruit non-UK staff from 2021. The rest, 25% said they might be considering it.

Many companies reported stopping European recruitment due to the new, higher costs and administration around recruitment, and others were planning to recruit and employ staff in Europe in the future:

- We will reduce the number of European heads in the office as we won’t be able to recruit new staff from Europe due to salary levels being lower than the minimum for juniors. Future employment of operational staff will be based in Europe.

- Unclear yet as it depends on the final costs but we may stop bringing in people from European countries, and may employ them remotely in-country. We may not be able to continue our UK- based internship programme for students/new grads. That may be remote from abroad too.

- Having experienced the recruitment system for non-EU staff and how hard it is, we expect additional work and effort for EU staff after end of free movement

- We won’t be able to afford to employ anyone from outside of the UK due to minimum salary restrictions (unless there are exceptions).

The demographics

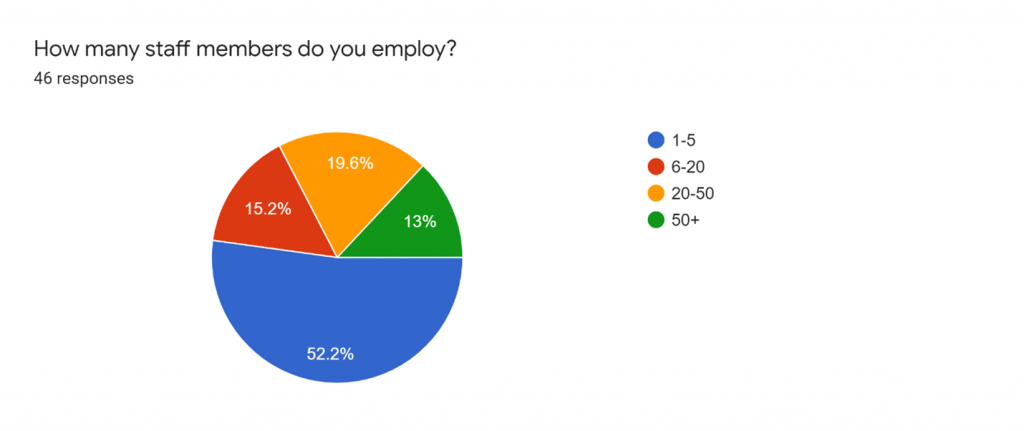

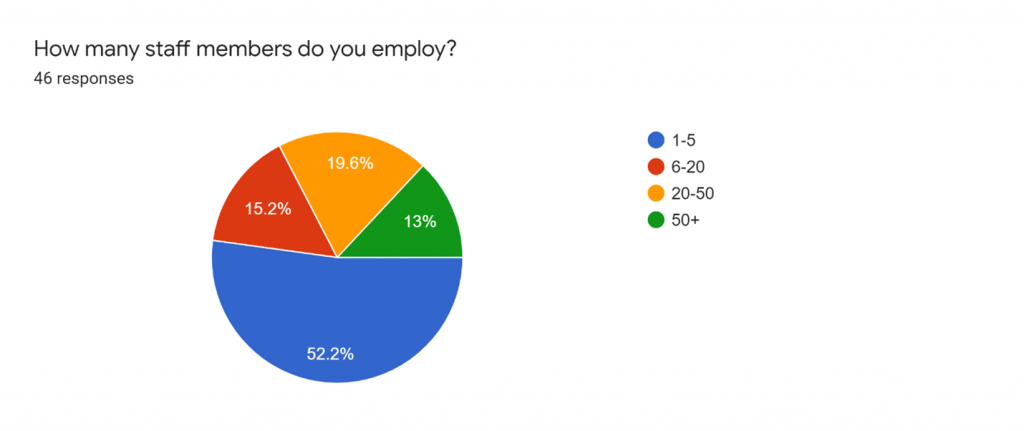

The demographics of the 46 survey respondents are a good representative mix, with just over half of respondents in the micro company category with 1-5 staff members, and between 13% and 20% of respondents employing 6-20, 20-50 and over 50 staff members.