Global Horizons Showcases International Trade Insights in Collaboration with Leading Industry Bodies

The Association of Translation Companies is collaborating with the Chartered Institute of Export & International…

Over the past three months, the UK’s Office for National Statistics (ONS) has been surveying UK businesses in different industry sectors on the impact of the coronavirus pandemic. In this overview, we compare some of the key findings from the ONS against the ATC’s Coronavirus Pulse Surveys, to gauge how the UK’s language services industry is faring against the national average. We also look at developments in various industry sectors within the UK, and present ONS data relevant to language service companies acutely looking to understand how different client sectors are performing.

Mid-March to Mid-May 2020

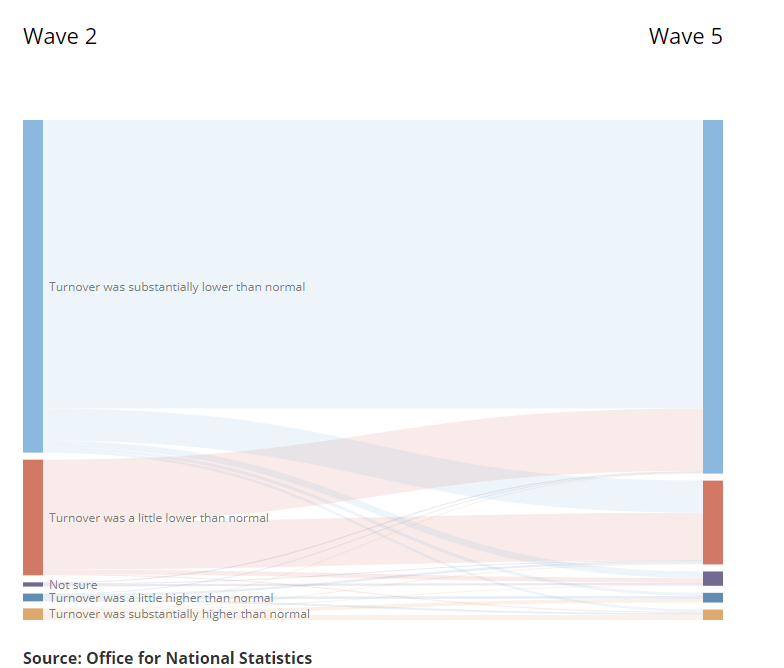

According to the ONS, over four waves of surveys in the two months between mid-March to mid-May 2020, 28% of businesses had temporarily closed or paused trading at some point. By the end of this period, 37% had restarted trading, and less than 1% had permanently ceased trading. In terms of turnover, 91% of businesses reported turnover outside normal range. Out of these companies, 55% recorded turnover that was considered substantially lower than normal, and 7% reported that turnover was a little lower than normal.

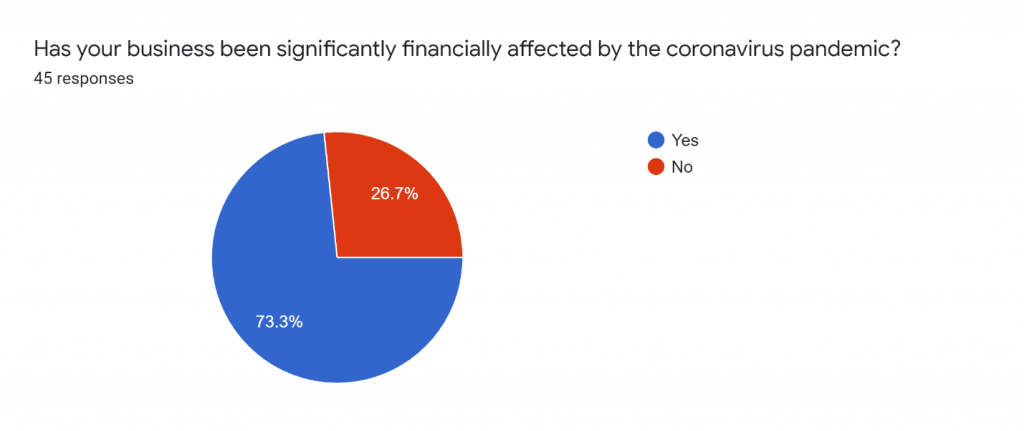

These figures show a striking parallel to the ATC’s Coronavirus Pulse Survey in mid-May, where 65% of language service companies had been significantly financially affected by the pandemic.

Out of these companies,

Late May to Mid-June

At the national level, according to the ONS’ latest survey wave in late May, these figures remained fairly static, with 65% of businesses who had continued to trade reporting lower than normal turnovers.

In contrast, the ATC’s Coronavirus Pulse Survey in mid-June revealed that a considerably higher proportion of language service companies were now reporting being significantly financially affected: 73%.

One concern voiced by many language service companies during the pandemic has been that, as a service industry to other sectors, our business is not as likely to “bounce back” as many others once lockdowns worldwide are lifted and businesses are expected to resume trading.

It’s clear from conversations we’ve had with members that there is an expectation of a delayed or prolonged effect for the language services industry, as client companies scale back on marketing, development and product launches, or simply put language services on hold for the time being.

For the language services industry, the effects of the pandemic may span well beyond the lifting of lockdown restrictions and the opening up of public and commercial life, and the ATC will continue to track these figures closely.

However, it should be mentioned that during the previous global financial crisis, and indeed over the course of the past two decades, the language services industry has continued to grow year-on-year at a rate of 5-6% despite severe blows to certain client sectors and verticals. As a precedent, that’s a powerful one, and researchers expect the language services industry to fully recover.

For further language industry trends and predictions, see Nimdzi Insights’ CEO Renato Beninatto, in Patterns instead of trends: what we know and what we don’t know at the #LocFromHome conference, as well as Don DePalma, CSA Research’s CSO & Founder in The End of the Language Business as We Know It?

A question many language service company owners and managers are thinking right now is which sectors or verticals to focus sales efforts on. Here, data from the ONS may help us reveal some insights.

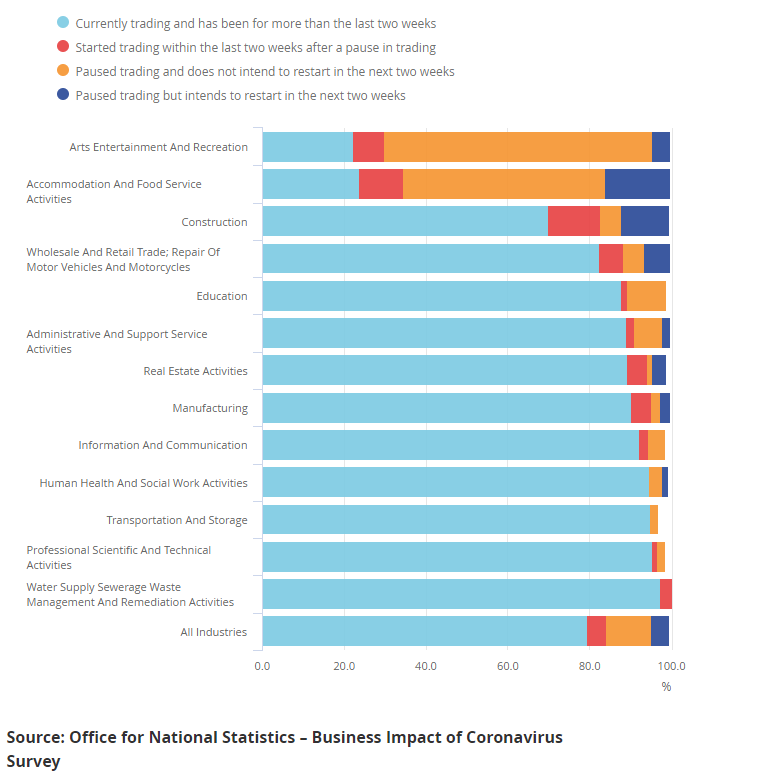

The latest published ONS survey for late May shows some interesting trends per sector, including proportions of companies currently trading, those resuming trade, and those who had not intended to start in June.

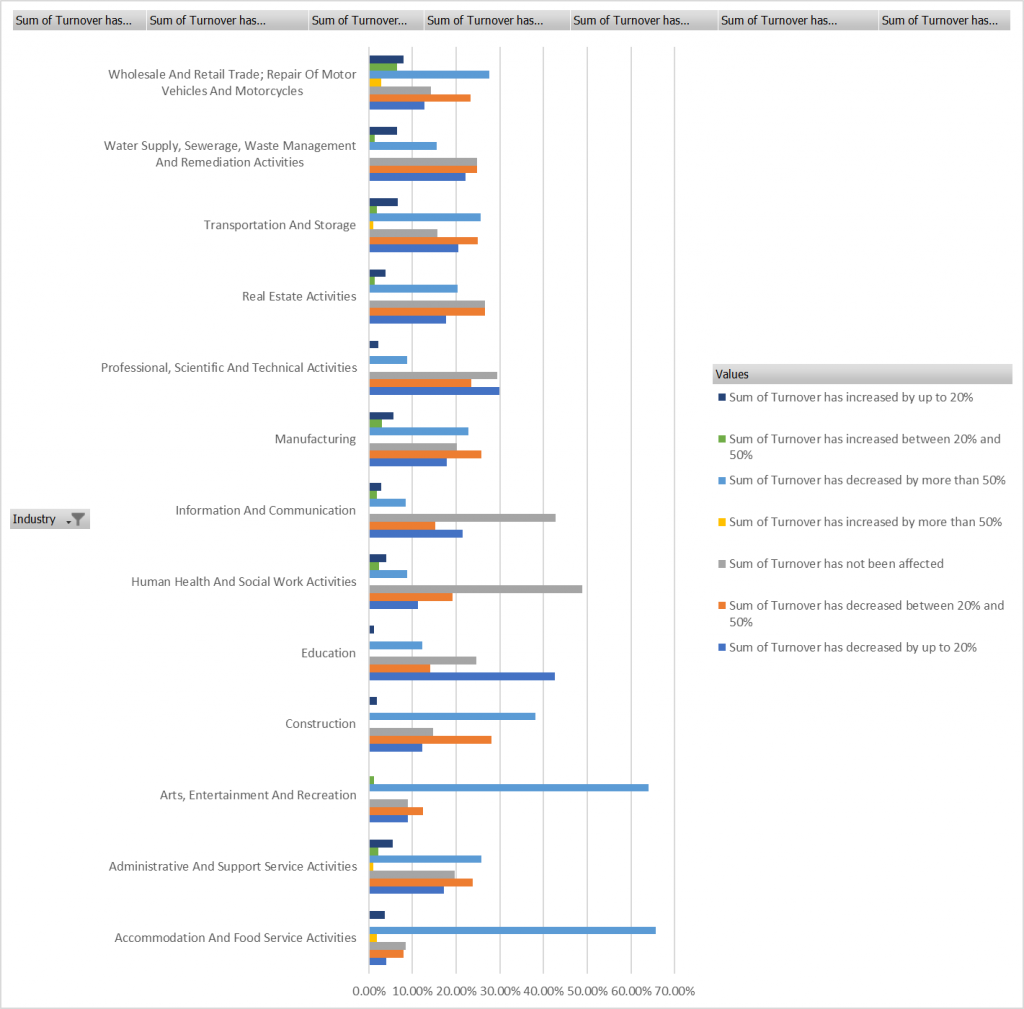

Of the businesses who were continuing to trade, the main sectors to have reported the highest increased turnover were wholesale and retail trade (17%) and transportation and storage (10%).

Not surprisingly, the main sectors to have reported that their turnover decreased by more than 50% were the accommodation and food service activities sector (66%), the arts, entertainment and recreation sector (64%), and the construction sector (38%).

The human health and social work activities (non-public sector businesses only), and the information and communication sector reported the largest percentages of businesses who responded that their turnover had been unaffected in the period, at 49% and 43% respectively.

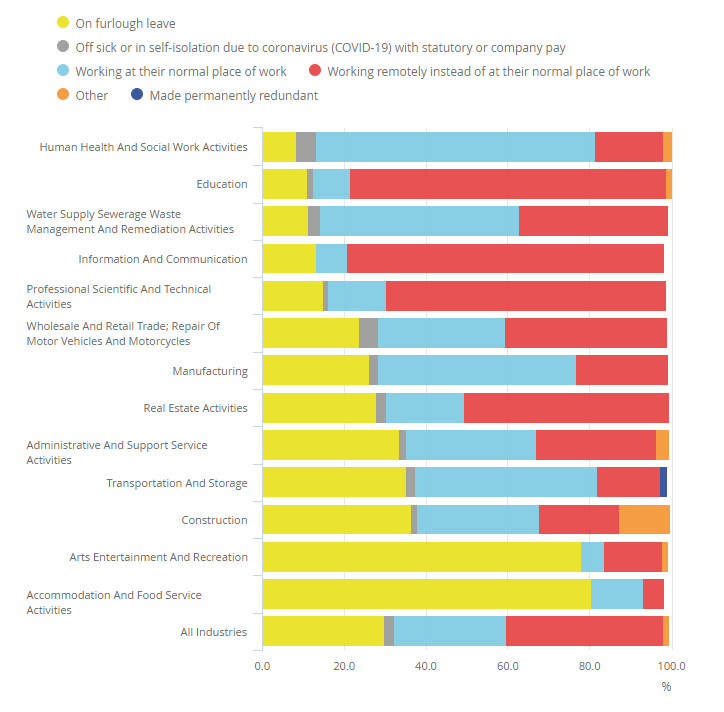

Perhaps yet another indicator of business performance for the various sectors is staff on furlough, which indicates significant disruption of trade.

These are the working arrangements of businesses who haven’t permanently stopped trading in late May.

One of the areas surveyed by the ONS in late May was online sales, which may specifically interest language service companies.

The wholesale and retail trade, and accommodation and food service activities sectors, reported the largest percentages of increased online sales, at 44% and 36% respectively. The administrative and support service activities sector reported the largest percentage of businesses indicating that online sales have continued but have decreased, at 43%.

The most common online service used was an increase or new use of video conferencing for internal communications, at 66%, followed by an increase or new use of online services to help communication with customers, at 31%, while 26% reported using none of the specified online services to support business operations.

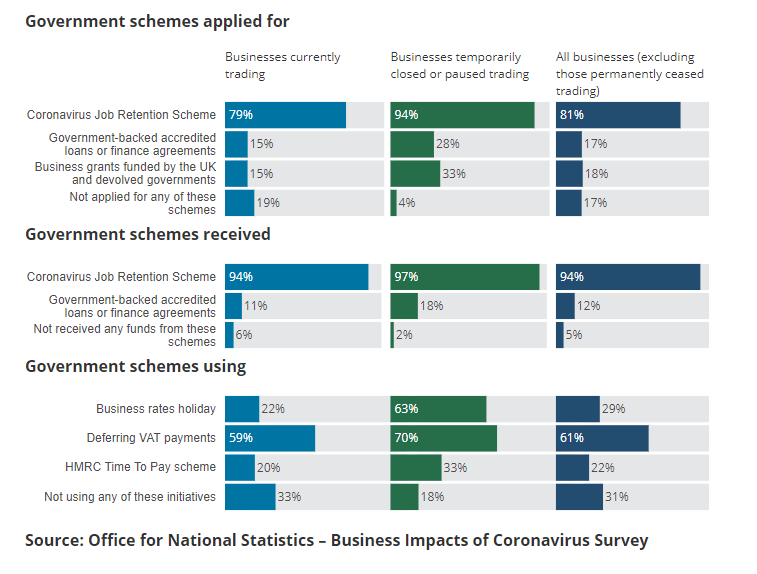

One of the areas tracked by the ATC’s Coronavirus Pulse Survey since April has been UK language service companies’ use of available Government support.

At a UK level, there has clearly been a high level of take-up of the Coronavirus Job Retention or Furlough Scheme, business grants, and VAT payment deferrals.

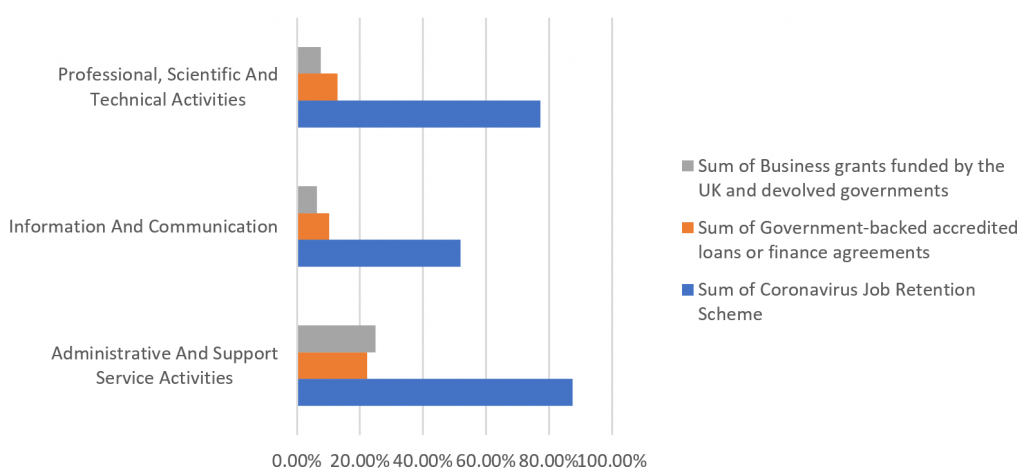

To compare support figures against the language services industry, however, we should look at the sectors which most correspond to ours, as reported by the ONS in late May.

(In ONS’ classification, translation and interpreting services sit within Professional, Scientific And Technical Activities.)

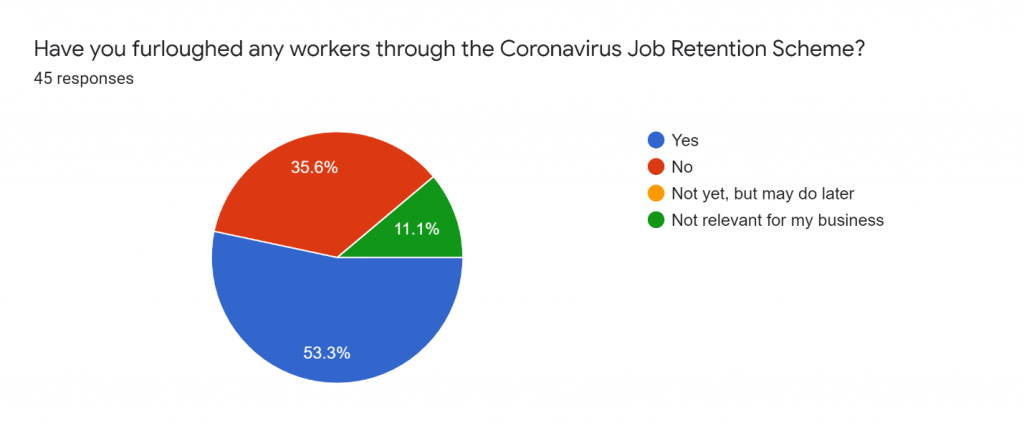

The corresponding ATC figures from the mid-June Pulse Survey clearly indicate that, at 53%, language service companies have furloughed a significantly smaller proportion of their staff than administrative and support service activities, but more than the information and communication sector.

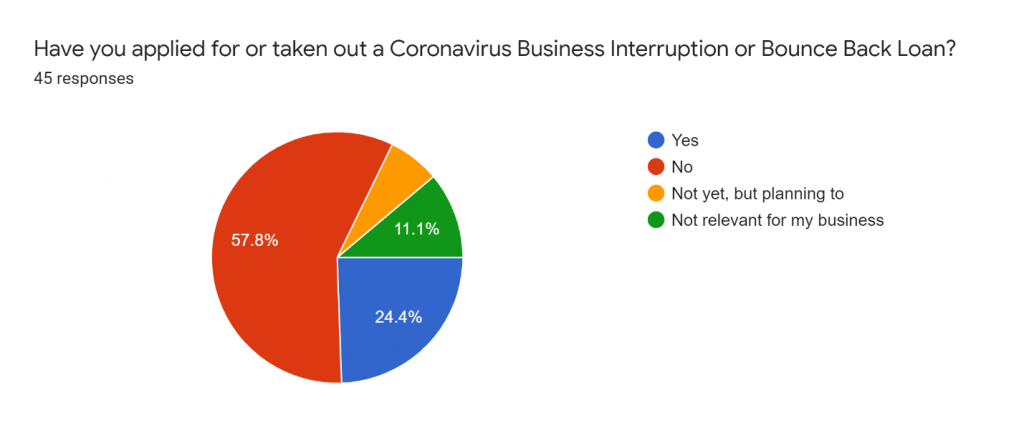

In terms of borrowing, language service companies, with 24% having applied for or taken out a loan, are on a par with administrative and support service activities nationwide.

The statistics gathered by the ONS are a fascinating insight into the impact of the coronavirus pandemic on the UK’s businesses. Beyond this overview and the ONS survey reports linked to here, you can download the entire datasets for all of the survey waves here, and dig further into the different statistics.

It’s challenging to draw any definite conclusions from comparing UK-wide sectors surveyed at bi-weekly intervals to our monthly language services surveys, but we may here see a trend emerging of the language services industry being affected for longer than businesses on average due to its supporting status.